Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Group】--EUR/MXN Forecast: Consolidates Ahead of ECB Decision

- 【XM Market Analysis】--GBP/USD Forex Signal: Cable Roars Higher in Early Trading

- 【XM Market Analysis】--EUR/USD Forex Signal: Bearish Amid Fed and BoE Divergence

- 【XM Forex】--GBP/USD Forecast: Looking for Higher Levels

- 【XM Market Analysis】--EUR/USD Forex Signal: Remains on Edge, With a Bearish Brea

market news

The Fed's Eagle is called the King of Anti-Observation, and the gold and silver are too big to be in the sky.

Wonderful introduction:

A clean and honest man is the happiness of honest people, a prosperous business is the happiness of businessmen, a punishment of evil and traitors is the happiness of chivalrous men, a good character and academic performance is the happiness of students, aiding the poor and helping the poor is the happiness of good people, and planting in spring and harvesting in autumn is the happiness of farmers.

Hello everyone, today XM Foreign Exchange will bring you "[XM Group]: The Fed's Eagle is called the King of Anti-Observation, and the gold and silver are too big after the sky is too small." Hope it will be helpful to you! The original content is as follows:

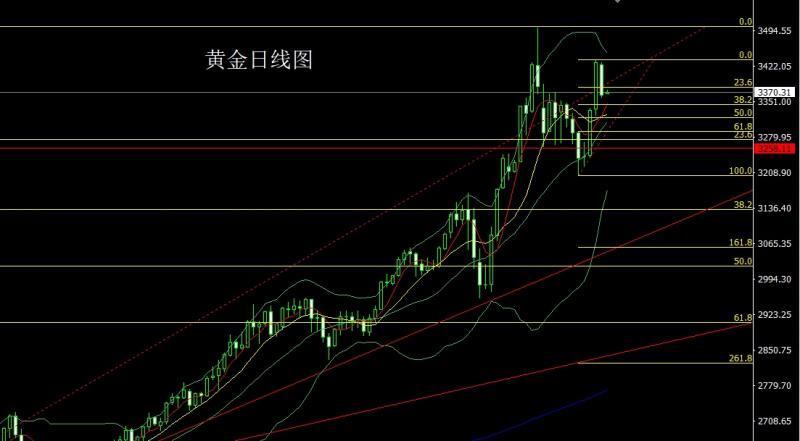

Yesterday, the gold market opened slightly lower in the early trading at 3425.9, and the market slightly filled the gap. The market started a decline process. The daily line was given the lowest position of 3359.8, and the market fluctuated and rose. Then it consolidated in the 3398-3363 range. The daily line finally closed at 3364.2, and the market closed with a large negative line with a slightly shadow line. After this pattern ended, it first pulled up today and gave 3392 short conservative 3395 short stop loss 3399. The target below looks at 3363 and 3355-3352 falling below 3345 and 33355 are prepared to leave.

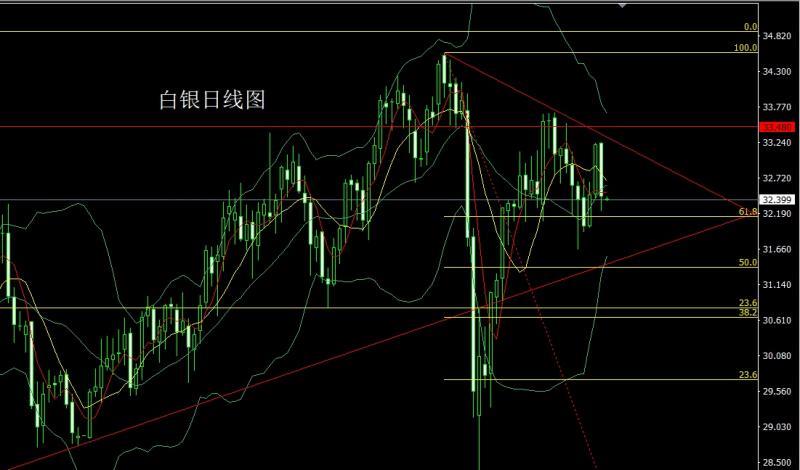

The silver market opened slightly higher yesterday at the position of 33.233 and then rose slightly. The market fell strongly. The daily line was at the lowest point of 32.232. After the market was consolidated. The daily line finally closed at the position of 32.446 and then closed with a large negative line with a long lower shadow line. After this pattern ended, the daily line was yin and yang. Today, it first pulled up to give a short stop loss of 32.8. The target below looked at 32.35 and 32.2 and 32-31.9 to leave.

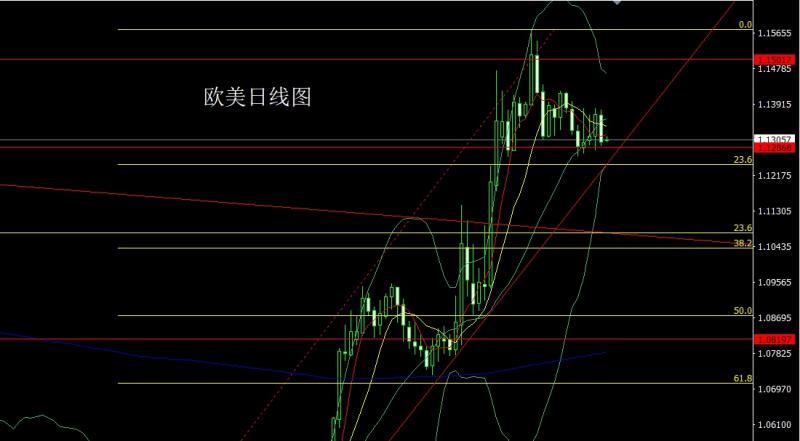

European and American markets opened at 1.13661 yesterday and the market fell first and gave 1After the position of .13248, the market rose rapidly. After the daily line reached the highest point of 1.13781, the market fell twice. After the daily line was at the lowest point of 1.12909, the market consolidated. The daily line finally closed at the position of 1.12992. Then the market closed with a large negative line with an upper shadow slightly longer than the lower shadow. After this pattern ended, the short index of 1.13450 today was 1.13600, and the target was 1.12900 and the target was 1.12900. 12750, falling below 1.12650 and 1.12500-1.12350.

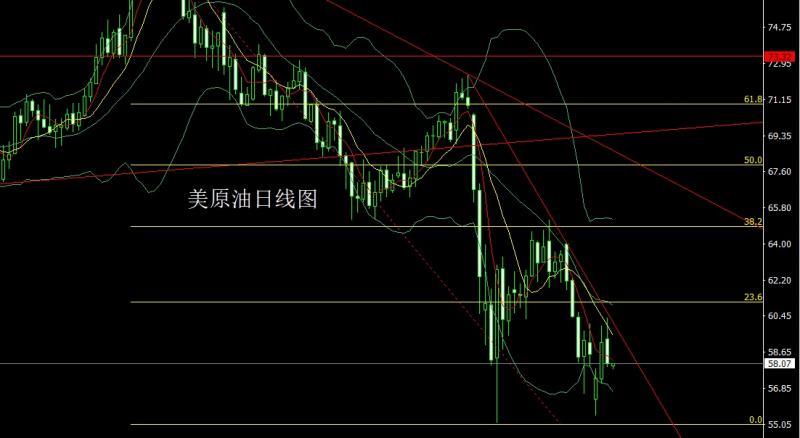

The US crude oil market opened slightly higher yesterday at the position of 59.28, and then the market first rose to the position of 60.39, and then the market fell strongly. The daily line was at the lowest point of 57.9, and the market consolidated. The daily line finally closed at the position of 58.07, and the market closed with a long upper shadow line. After this pattern ended, the short stop loss of 59.75 today at 59.2, and the target below was 58 and 57.5 and 57-56.6.

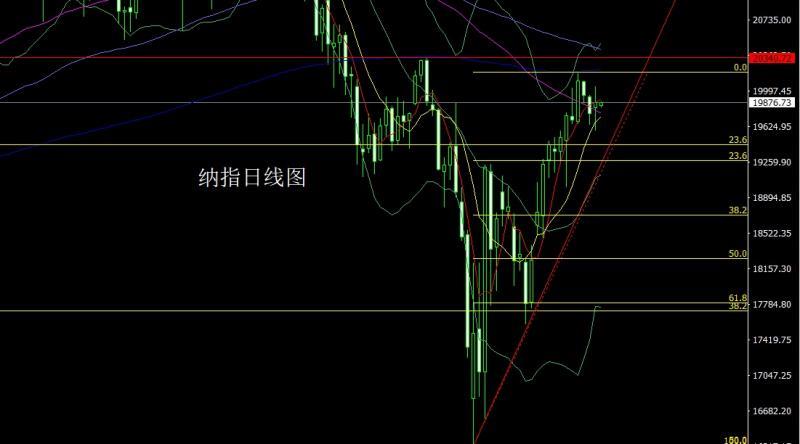

Nasdaq index market opened higher yesterday at 19824.21, and the market first rose to 20044.97, and then fell sharply. The daily line was at the lowest point of 19590.03, and the market rose strongly at the end of the trading session. The daily line finally closed at 19874.92, and the market closed in a spindle pattern with a lower shadow line longer than the upper shadow line. After this pattern ended, the short stop loss of 20150 today in 20050 today. The target below looks at 19800 and 19700 and 19550.

The fundamentals, yesterday's fundamentals market focused on the Federal Reserve's interest rate resolution in the early morning of today. The Federal Reserve kept interest rates unchanged for the third time in a row. The statement emphasized the rising risk of inflation and unemployment. Powell yelled the uncertainty factor and the low cost of continuing to wait and see, saying he was not in a hurry to cut interest rates. Powell also said he had no intention of meeting with the U.S. president, whose call for a rate cut would not hinder the Fed's work. Therefore, the US index was supported, gold, silver and non-US currencies fell, and in terms of India-Pakistan conflict, India took the initiative to attack Pakistan the night before yesterday, but India was shot down six fighter jets. It can be said that India's xm-links.combat power is still constant, but the Pakistani Defense Minister said yesterday that he was trying to avoid a "full war." So as long as India does not want to expand the war in terms of dying Pakistan, after all, even if it wins India, there is nothing to get. Today's fundamentals mainly focus on the Bank of England's announcement of interest rate resolutions, meeting minutes and monetary policy reports at 19:00 in the evening. Later, look at the number of people who requested unemployment benefits in the United States from 20:30 to May 3, and then look at the monthly wholesale sales rate in the United States at 22:00. Look at the US New York Fed's 1-year inflation expectations in April at 23:00 later.

In terms of operation, gold: first pull up today, give 3392 short conservative 3395 short stop loss 3399. The target below looks at 3363 and 3355-3352 falling below 3345 and 33355 to leave the market.

Silver: Today, we will first pull up and give a short stop loss of 32.8. The target below is 32.35 and 32.2 and 32-31.9 to leave the market with a lot of preparation.

Europe and the United States: Today's 1.13450 short index is 1.13600, and the target is 1.12900 and the target is 1.12900. 12750, if you fall below, see 1.12650 and 1.12500-1.12350.

U.S. crude oil: 59.2 short stop loss today, 59.75, look at 58 and 57.5 and 57-56.6.

Nasdaq: 20050 short stop loss today, look at 20150, look at 19800 and 19700 and 19550.

The above content is all about "[XM Group]: The Fed Eagle is called the King of Anti-Observation, gold and silver are big and long after the short". It was carefully xm-links.compiled and edited by the editor of XM Forex. I hope it will be helpful to your trading! Thanks for the support!

Share, just as simple as a gust of wind can bring refreshment, just as pure as a flower can bring fragrance. The dusty heart gradually opened, and I learned to share, sharing is actually so simple.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here