Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Decision Analysis】--USD/MYR Analysis: Additional Bearishness Followed with a

- 【XM Forex】--USD/CHF Forex Signal: Eyes Breakout at 0.92

- 【XM Market Review】--USD/MXN Analysis: Nervous Sentiment Causing a Volatile Forex

- 【XM Market Analysis】--XAU/USD Forecast Gold Continues to See Buying Pressure

- 【XM Decision Analysis】--EUR/CHF Forecast: Holds Above 0.9450, Eyes Upside Potent

market analysis

Xiaopu disrupts the market in the early morning, and operates in gold and silver ranges

Wonderful Introduction:

Only by setting off can you reach your ideals and destinations, only by working hard can you achieve brilliant success, and only by sowing can you gain. Only by pursuing can one taste a dignified person.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Platform]: Xiaopu disrupts the market in the early morning, and gold and silver range operations". Hope it will be helpful to you! The original content is as follows:

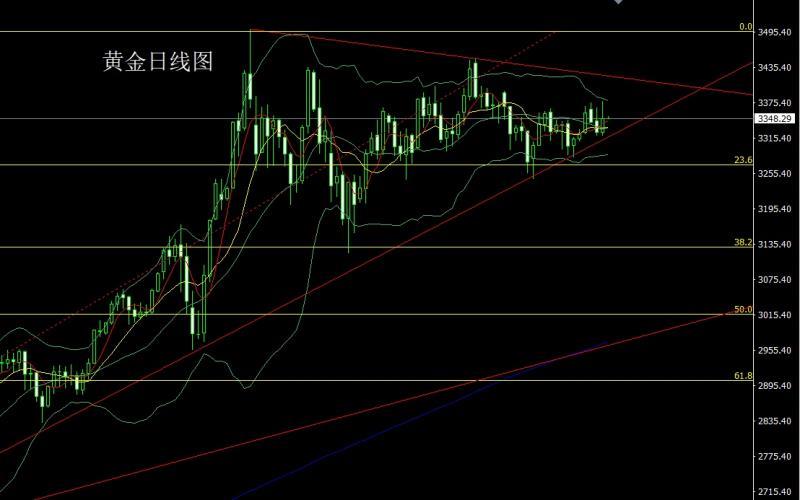

Yesterday, the gold market opened at 3324.3 in the morning and then the market rose first. The pressure point of 3342.8 was given. The market fell strongly. The daily line was at the lowest point of 3319 and then the market rose in the early morning. The market was affected by the rumors of dismissal of Powell. The market stress rose. The daily line reached the highest point of 3378 and the White House denied it. After the daily line finally closed at 3347.3. After the daily line closed in a very long upper shadow line, the daily line closed in a reverse hammer head pattern with an extremely long upper shadow line. After this pattern ended, it fell back to 3330 and stopped loss 3325 today. The target was 3342 and 3350-3355 to leave the market and prepare to short

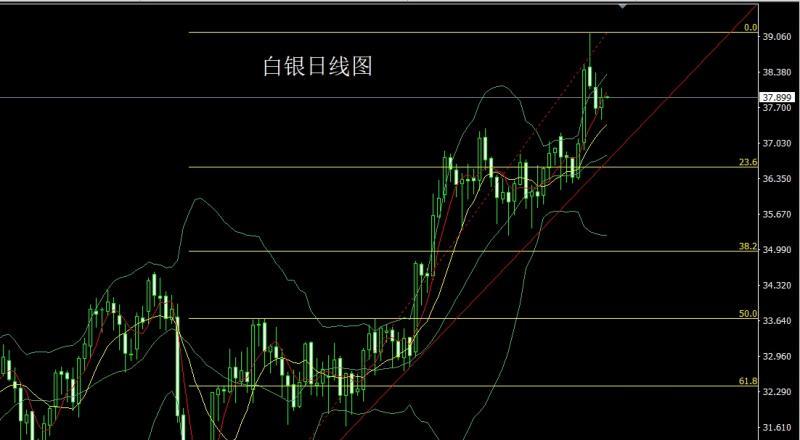

The silver market opened at 37.708 yesterday and then the market rose first, and then gave the daily high of 38.079. The market fell strongly. The daily line was at the lowest level of 37.473 and then the market rose at the end of the trading session. The daily line finally closed at 37.897. Then the market closed with a spindle pattern with an upper and lower shadow line. After this pattern ended, it fell back to 37.6 today, with a stop loss of 37.45. The target was 37.85 and 38.

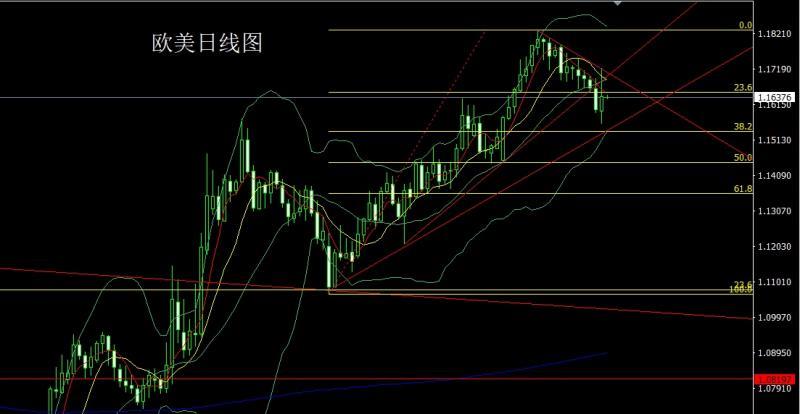

The European and American markets opened at 1.15970 yesterday and then rose directly. The market rose directly. The position of 1.16284 was given and the market fell strongly. The daily line was the mostAfter the low was given to the position of 1.15613, the market rose strongly in the early morning. The daily line reached the highest position of 1.17211 and then the market fell at the end of the trading session. The daily line finally closed at the position of 1.16386. The market closed with a medium-positive line with an upper shadow line longer than the lower shadow line. After this pattern ended, it fell back to 1.15950 today and stopped 1.15750. The target was 1.16400 and 1.16800 to leave the market and prepare to short

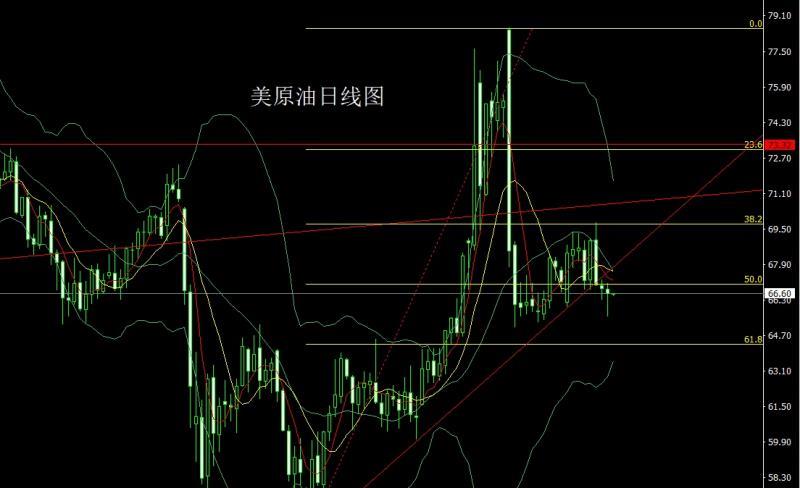

The U.S. crude oil market opened at 66.78 yesterday and the market rose directly. The daily line reached the highest position at 67.04 and then fell strongly. The daily line was at the lowest position at 65.57 and then the market rose at the end of the trading session. The daily line finally closed at 66.59 and then closed with a very long lower shadow line. After this pattern ended, the 66-long stop loss today was 65.5, and the target was 67 and 67.5-68.

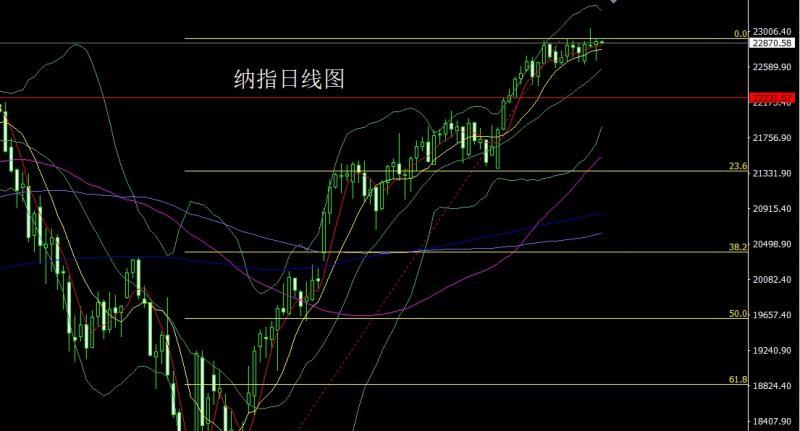

The Nasdaq market opened at 22853.04 yesterday and then the market fell first, giving the position of 22754, and then the market quickly rose, giving the position of 22917.11, and then the market fell strongly. The daily line was at the lowest point of 22661.98, and then the market rose strongly at the end of the trading session. The daily line reached the highest point of 22927.6 and then the market consolidated. The daily line finally closed at 22888.57, and then the market was with a very long hammer head with a lower shadow line. The pattern closed, and after the end of this pattern, the daily line constructed a rubbing range. At the point, the stop loss of more than 22750 today was 22680, with the target of 22850 and 22900 and 22950 and 23000.

The fundamentals, yesterday's fundamentals were relatively normal before the early morning session. The US PPI annual rate in June recorded 2.3%, lower than the expected 2.5%, the lowest since September 2024, with the previous value up from 2.6% to 2.7%. Fed Beige Book: The economic outlook is neutral to slightly pessimistic. Manufacturing activities have dropped slightly, and corporate recruitment has remained cautious. What caused the market to be violently turbulent is the news that the US President intends to fire Powell caused a triple kill of US stocks, bonds and foreign exchanges, and gold soared. The president then denied that the market would stabilize immediately after the market was stabilized. This uncontrollable speech beyond the technical scope is really a bomb in the current market. After this wide-scale wash-up, the Federal Reserve's policy will become the focus of market attention. The White House's urgent interest rate cut and the Federal Reserve's current indifferent policy will inevitably create stronger friction in the subsequent market. Today's fundamentals mainly focus on the final value of the euro zone's June CPI annual rate at 17:00. The U.S. market was 20:30 in the U.S. to July 12, and the U.S. retail sales monthly rate in June, the U.S. Philadelphia Fed Manufacturing Index and the U.S. import price index monthly rate in June. Watch it at nightNAHB real estate market index in July and US May xm-links.commercial inventory monthly rate at 22:00.

In terms of operation, gold: today, it will fall back to 3330 and stop loss 3325, the target will look at 3342 and 3350-3355 to leave the market and prepare for short

Silver: today, it will fall back to 37.6 and stop loss 37.45, the target will look at 37.85 and 38

Europe and the United States: today, it will fall back to 1.15950 and stop loss 1.15750, the target will look at 1.16400 and 1.16800 and prepare for short

US crude oil: 66-long stop loss today is 65.5, target is 67 and 67.5-68.

Nasdaq: 22750-long stop loss today is 22680, target is 22850 and 22900 and 22950 and 23000.

The above content is all about "[XM Foreign Exchange Platform]: Xiaopu's market is in chaos in the early morning, gold and silver range operation" is carefully xm-links.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Every successful person has a beginning. Only by having the courage to start can you find the way to success. Read the next article now!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here