Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- The US dollar index fluctuates, paying attention to "Tep Summit" and "terror dat

- Tariff threats to remove expectations hit the dollar hard, pound welcomes PMI da

- Increased supply of OPEC+ drags oil prices down by nearly 2%, Fed rate cut expec

- Guide to short-term operations of major currencies on July 21

- The Federal Reserve must cut interest rates, and gold ushers in a "savior"?

market analysis

Gold fluctuates gradually and continues to rise above 3356 tonight

Wonderful Introduction:

I missed more in life than not, and everyone has missed countless times. So we don’t have to apologize for our misses, we should be happy for our own possession. Missing beauty, you have health: Missing health, you have wisdom; missing wisdom, you have kindness; missing kindness, you have wealth; missing wealth, you have xm-links.comfort; missing xm-links.comfort, you have freedom; missing freedom, you have personality...

Hello everyone, today XM Foreign Exchange will bring you "[XM Official Website]: Gold fluctuates gradually, and it will continue to be bullish tonight above 3356." Hope it will be helpful to you! The original content is as follows:

Zheng's silver point: Gold fluctuates gradually rises, and it continues to be bullish above 3356 tonight

Review the market trend and technical points that appeared last Friday:

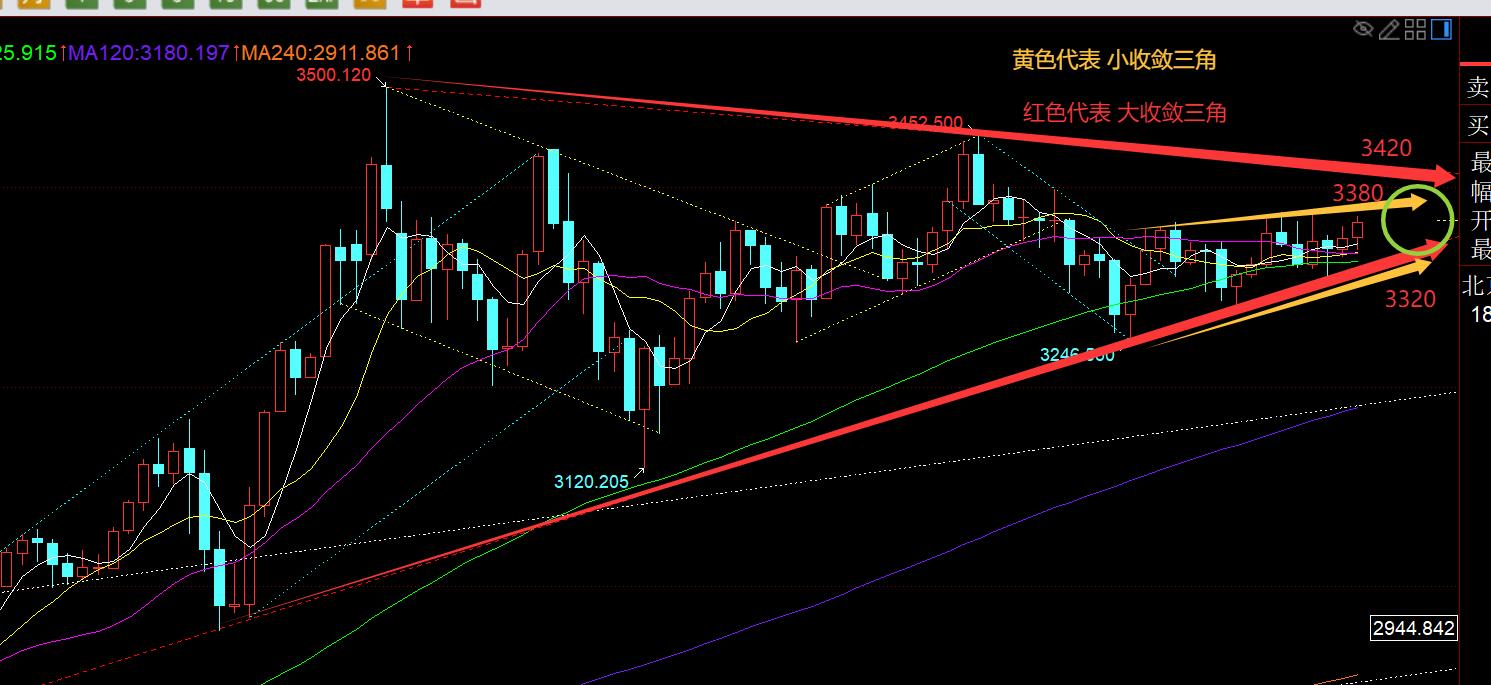

First, in terms of gold: Last Thursday, the daily line closed at a long lower shadow and stabilized K, and was once again stable at the lower rail support point of the large convergence triangle. xm-links.combined with the two cycles of stabilizations of 3247 and 3282, both of which were three consecutive positive pulls up; therefore, last Friday and Monday will rise for at least the two days; in addition, last Thursday was strong overnight and pulled up all the way, and if you want to continue to rise on the second day, the retracement is generally the extreme 382 segment support, that is, the 3331 line, and the mid-track of the hourly line also has support, so when it touches these two positions before and after the European session, they continue to fluctuate and look up. , and finally, it was expected to rise one wave to 3361; then the European session broke high, and the US session had a second pull-up, but because the US session rose directly before and after, it could only choose to lure the short back and forth after 22 o'clock. The fluctuation that night was not large, so the second move was left to Monday, which reached the highest point of 3370, which was once again in line with the bullish idea;

Second, silver: last Friday, relying on the top and bottom of the 38.2 line, it continued to be bullish, and Moji only ushered in some breaking momentum today, and also made some profits;

Third, crude oil: originally retraceeded back to 67 and continued to fluctuate and bullish, but last weekFive Asian and European sessions will rise slowly and then go upwards, and then you can only follow 68 directly, with a maximum of 68.9, a little far away from the target, and a little farther away from 100 points to reduce holdings. In the end, the US market did not pull up twice, but turned downward, losing the intraday low of 67.4 and was eliminated;

Today's market analysis and interpretation:

First, gold daily line level: 3310 line converges the lower track of the triangle and stabilizes again, and then follow the cycle method, which will be in a pull-up state for at least three consecutive days, and today is the third day; if the derivative pressure point 3380 line corresponding to the trend resistance line still fails to directly break through the stand, it may be necessary to suppress again One wave, repeatedly test the support point of the lower rail of the large convergence triangle, but one thing can be found that 3365 suppressed that time, the callback time was five days, while 3377 suppressed that time, the callback time was four days. This is actually not difficult to understand, because the low point of the lower rail trend line is constantly moving upward, and the force of the upper trend resistance line breaking through the high is not very large, which leads to the narrowing of the small convergence triangle. Therefore, if 3380 is suppressed and then slides down, the time for the time to pull back will not exceed three days; until the market finally waits for the market to choose the breakthrough direction, before the lower rail support has not been effectively lost, individuals will continue to tend to wait for the upward breakthrough, and wait for the market to break through and stand on the upper rail of the small convergence triangle. , we will test the pressure of the upper rail line of the large convergence triangle (3500-3452), which will move down 3420 line this week; and only by breaking through the upper rail of the large convergence triangle can we officially have the probability of starting a large one-sided pull-up, returning to the bull market, and the adjustment is over, which is expected to be made within two weeks at most;

Second, the golden hourly line level: This morning, slightly fell to 3346 line and stabilized, and the bottoming up and then broke through the middle rail of the hourly line again, which means short-term stability. The 3361 suppression adjustment ended overnight, and the second pull-up was seen. This was supposed to happen last Friday's US market, delayed to today, and finally reached the 3366 target and hit 337 0 line; then today's Asian session rise, European session continues to break high, and US session still has a second pull-up; however, because it is in a period of oscillation, patiently wait for a retracement to stabilize before taking action, and pay attention to the 382 segment support, that is, 3361-60, which happens to be the support point of the top and bottom conversion, followed by 3358-56, 50 segment support and the middle track, the limit is here, and then the afternoon starting point 3350 cannot, and it should not break, otherwise it will encounter oscillation and washing the market back and forth; the upper resistance level is concentrated 3370-3380, and it is expected that 3380 will not be able to break through in one breath. You can try to see the decline when you get close for the first time;

In terms of silver: Today's silver resistance is 38.6-38.65, support 38.1-38.2, and it must be oscillated and consolidated within the range, and continue to oscillate and slow upward; if the strong attack breaks through the resistance level, continue to pull up to 38.8-39;

Crude oil: Last Friday closed higher on the long upper shadow K, with a short-term suppression. From the above chart, it returned to the downward channel. However, the current price is not suitable for chasing downward. On the one hand, it is due to the short-term macd bottom divergence, and on the other hand, the 65.5 line is just the 618 segment support of the previous wave of upward retracement. Therefore, tonight, I think to keep 65.5, first look up a wave of rebound, then gradually get below the upper track below 67.3, and then choose to bearish when it is high;

The above are several points of the author's technical analysis, as a reference, and it is also a summary of the technical experience accumulated by the market watching and reviewing for more than 12 hours a day in the past twelve years. Tianhu will disclose technical points, and cooperate with text and video interpretation. Friends who want to learn can xm-links.compare and reference based on actual trends; those who recognize ideas can refer to operations, lead defense well, and risk control first; those who do not agree should just be floating by; thank everyone for their support and attention;

[The article views are for reference only. Investment is risky. You should be cautious in entering the market, operate rationally, strictly set losses, control positions, risk control first, and bear the profit and loss at your own risk]

Contributor: Zheng's Dianyin

A study on the market for more than 12 hours a day, persist for ten years, and detailed technical interpretations are made public on the entire network, serving the whole network with sincerity, sincerity, perseverance and wholeheartedness! xm-links.comments written on major financial websites! Proficient in the K-line rules, channel rules, time rules, moving average rules, segmentation rules, and top and bottom rules; student cooperation registration hotline - WeChat: zdf289984986

The above content is all about "[XM official website]: gold fluctuates gradually, and it will continue to be bullish tonight" is carefully xm-links.compiled and edited by the editor of XM Forex. I hope it will be helpful to your trading! Thanks for the support!

Due to the author's limited ability and time constraints, some content in the article still needs to be discussed and studied in depth. Therefore, in the future, the author will conduct extended research and discussion on the following issues:

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here