Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- US dollar suppresses below 98, US and Europe reach a trade agreement

- Practical foreign exchange strategy on July 21

- Daily hammer head is waiting for speech, gold and silver are short and pressure

- In the most uneasy week in August, can a set of data be exchanged for two intere

- Gold prices continue to hit historical highs, pointing to the 3600 mark, weak US

market analysis

N-character breaks the big positive line, gold and silver continue to be low

Wonderful Introduction:

I missed more in life than not, and everyone has missed countless times. So we don’t have to apologize for our misses, we should be happy for our own possession. Missing beauty, you have health: Missing health, you have wisdom; missing wisdom, you have kindness; missing kindness, you have wealth; missing wealth, you have xm-links.comfort; missing xm-links.comfort, you have freedom; missing freedom, you have personality...

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Market Review]: N-character breaks the big positive line, and gold and silver continue to have low long." Hope it will be helpful to you! The original content is as follows:

Yesterday, the gold market opened at 3397 in the morning and then rose slightly. After giving a position of 3402.9, the market fell strongly. It gradually reached the lowest point of 3382.9 and then rose strongly. The triangle breaks through 3420 and then reached the highest point of 3433.6. After the market consolidates. The daily line finally closed at 3430 and then closed with a large positive line with a long lower shadow line. After this pattern ended, the daily line effectively broke the pressure. Today's market rebound continued to be long. At the point, today's 3418 is more conservative 3415 is more stop loss 3411, and the target is 3434. The break is 3442 and 3450-3453 pressure range.

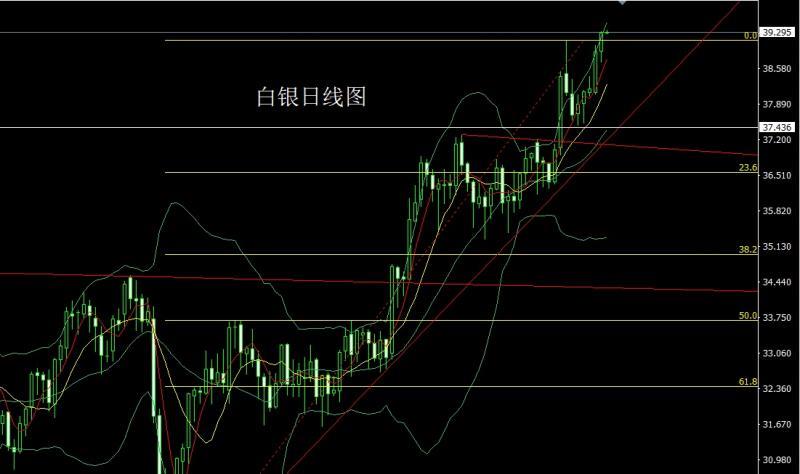

The silver market opened at 38.921 yesterday and the market fell first. The daily line was at the lowest point of 38.7 and then the market rose strongly. The daily line reached the highest point of 39.307 and then the market consolidated. The daily line finally closed at 39.278 and then the market closed with a medium-positive line with a long lower shadow line. After this pattern ended, the daily line effectively broke the pressure. At the point, the daily line was more than 38.9. The target was 39.3 and 39.5 and 39.65.

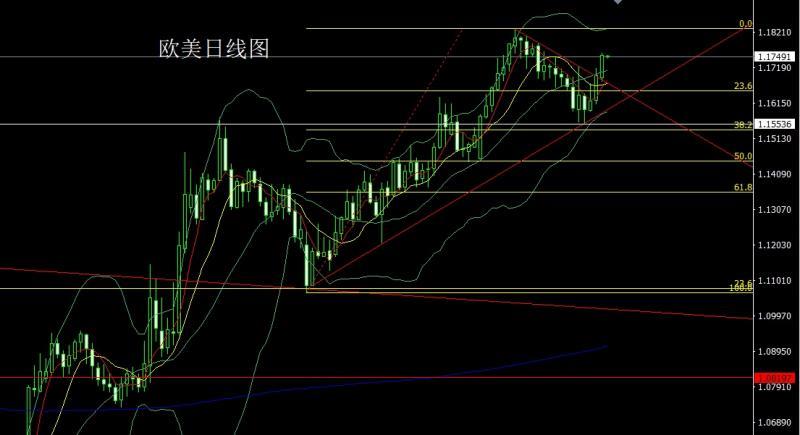

European and American markets opened lower yesterday at 1.16893 and then the market fell first to give a position of 1.16776. The market rose strongly in the early morning. The daily line reached the highest position of 1.17609 and then the market consolidated. The daily line finally closed at 1.17533 and then the market closed with a large positive line with a lower shadow line slightly longer than the upper shadow line. After this pattern ended, the stop loss of more than 1.17200 today was 1.17000, and the target was 1.7500 and 1.17700 and 1.18000.

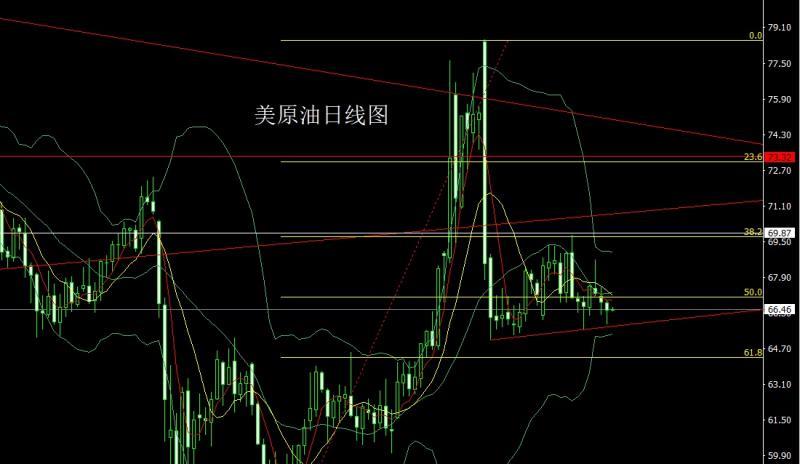

The US crude oil market opened at 66.76 yesterday and the market rose slightly. The daily line level high point was 66.84, and the market fell strongly. The daily line was at the lowest point of 65.8. After the market was supported by the lower track of this round of range consolidation, the daily line finally closed at 66.43. After the market closed with a hammer-like pattern with a very long lower shadow line, the end of this pattern was 65.9 and the stop loss of 65.6 today. The target was 66.4 and 66.8 to break the position and look at 67-67.2.

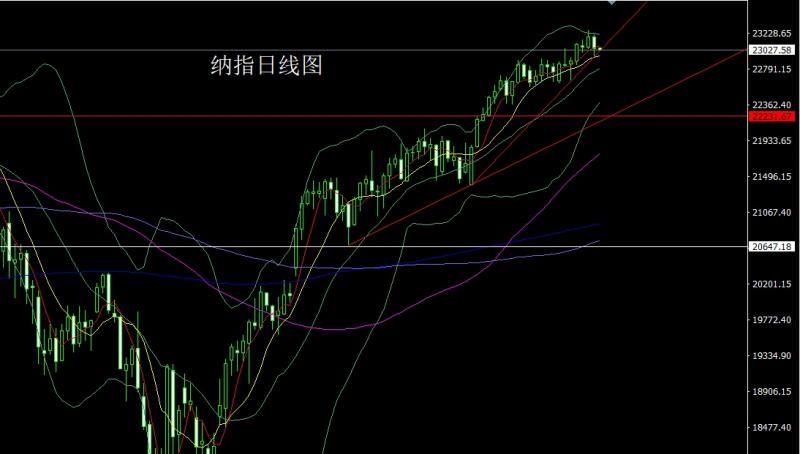

Nasdaq index market opened at 23185.68 yesterday and the market rose slightly. After giving a position of 23210.78, the market fell strongly. The lowest point of the day was given to the position of 22950.83. After the market was consolidated, the daily line finally closed at 23040.72. Then the daily line closed with a very long lower shadow line. After this pattern ended, 23170 short stop loss 23230 today, with the target of 23000 and 22950 and 22850.

Fundamentals, yesterday's fundamentals. The contradiction between the US government and the Federal Reserve deepened. US Treasury Secretary Bescent said that he called for an internal review of the Federal Reserve, and there was no sign that Powell should resign now. Fed Director Bowman said it is important that the Fed maintains independence in monetary policy and that the Fed has the responsibility to maintain transparency and assume accountability. The fundamental reason for the two sides' confrontation is that the Federal Reserve resists the U.S. government's hope for a rate cut as soon as possible. US Treasury Secretary Becent also said yesterday that August 1 is a "hard deadline" for all countries. The annual tariff revenue is expected to reach US$300 billion. Tariff revenue is likely to reach US$2.8 trillion in the next decade. Under risk aversion, the gold market has xm-links.completed an important breakthrough. Today's fundamentals focus on the initial value of the euro zone July consumer confidence index at 22:00 and the annualized total number of existing home sales in the United States in June. Then look at the EIA crude oil inventories in the US to July 18th week and the EIA Cushing crude oil in the US to July 18th weekInventory and the U.S. strategic oil reserve inventory for the week ended July 18.

In terms of operation, gold: today's 3418 is long and conservative 3415 is long and stop loss 3411 is long, and the target is 3434. The breaking position is 3442 and 3450-3453 pressure range.

Silver: 39.05 today's long stop loss 38.9. Targets are 39.3 and 39.5 and 39.65.

Europe and the United States: 1.17200 today's long stop loss 1.17000, targets 1.7500 and 1.17700 and 1.18000.

US crude oil: 65.9 today's long stop loss 65.6, targets 66.4 and 66 .8 breaks and sees 67-67.2.

Nasdaq Index: Today 23170 short stop loss 23230, and the target is 23000 and 22950 and 22850.

The above content is all about "[XM Foreign Exchange Market Review]: N-word breaks the big positive line, gold and silver continues to be low". It is carefully xm-links.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Only the strong know how to fight; the weak are not qualified to fail, but are born to be conquered. Step up to learn the next article!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here