Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Group】--EUR/USD Forecast: Tests 1.05 Resistance

- 【XM Market Analysis】--USD/INR Forecast: US Dollar Continues to Flex Against the

- 【XM Group】--USD/INR Monthly Forecast: December 2024

- 【XM Market Review】--NZD/USD Analysis: Caution Strikes Again as Near-Term Support

- 【XM Group】--Gold Analysis: Gold Eyes $2,800 as Fed Decision Looms

market analysis

【XM Group】--Weekly Forex Forecast – Gold, USD/JPY, S&P 500 Index, Natural Gas Futures, Copper Futures

Risk Warning:

The purpose of information release is to warn investors of risks and does not constitute any investment advice. The relevant data and information are from third parties and are for reference only. Investors are requested to verify before use and assume all risks.

Hello everyone, today XM Forex will bring you "【XM Group】--Weekly Forex Forecast – Gold, USD/JPY, S&P 500 Index, Natural Gas Futures, Copper Futures". I hope it will be helpful to you! The original content is as follows:

Fundamental Analysis & Market Sentiment

I wrote on 9th March that the best trades for the week would be:

The overall result was a loss of 8.69%, which is 2.90% per asset.

Last week saw several important data releases affecting the Forex market:

Last week’s key takeaways were:

The Week Ahead: 17th – 21st March

The xm-links.coming week has a lighter schedule of important releases, so we are likely to see less volatility in the Forex market over the xm-links.coming week.

This week’s important data points, in order of likely importance, are:

Monthly Forecast March 2025

For March 2025, I made no forecast, as there were no clear trends at the start of this month.

Weekly Forecast 16th March 2025

Last week, I forecasted that the following currency crosses would fall in value over the week:

- EUR/NZD – this fell in value by 0.26%.

- EUR/JPY – this rose in value by 0.82%.

This was not a profitable call overall.

This week, I make no forecast, as there were no unusually large price movements in any currency crosses.

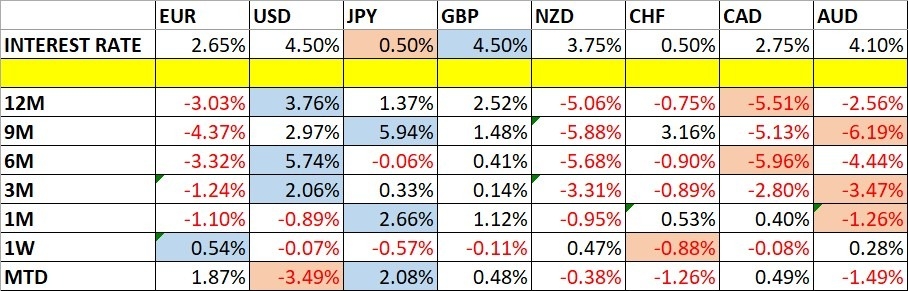

The Euro was again the strongest major currency last week, while the Swiss Franc was the weakest. Volatility decreased last week, with only 11% of the most important Forex currency pairs and crosses changing in value by more than 1%. It is likely to increase over the xm-links.coming week, as there is a much bigger agenda, with four major central banks due to hold policy meetings.

You can trade these forecasts in a real or demo Forex brokerage account.

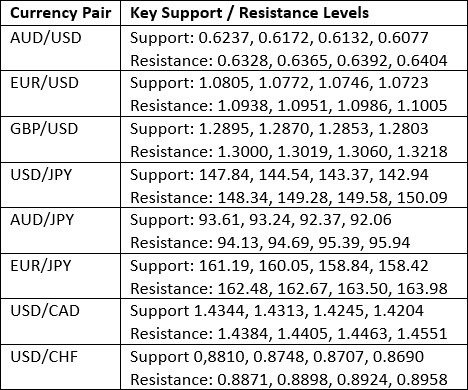

Key Support/Resistance Levels for Popular Pairs

Technical Analysis

US Dollar Index

Last week, the US Dollar Index printed a small bearish candlestick. The candlestick is small and a bit of a pin bar or maybe even a doji candlestick. So, it is a bearish weekly candle, but the bearish momentum seems to have slowed down.

The price is well below its level of 3 months ago, invalidating its former long-term bullish trend. At one point, the price reached a new 4-month low. However, the long-term trend is mixed and unclear.

The US Dollar is getting hit due to the ongoing tariff / trade war which is showing no resolution in sight. This is hurting the US Dollar.

Trades taken over the xm-links.coming week will probably be best positioned against the US Dollar, at least until a deal is announced replacing reciprocal import tariffs involving the USA.

Gold

Gold rose strongly at the end of the week to reach a new record high above the big round number at $3,000. The precious metal closed the week just a few dollars below that round number, at $2,984.

The price closed not far from the high of its range and is trading in all-time blue sky. It could be a little more bullish, but not by much.

Some analysts think that Gold is being boosted by safe haven flow, with the Japanese Yen less attractive due to high volatility, while the US Dollar is unattractive due to the effects of the ongoing US-centered trade war.

I see Gold as a buy right now.

USD/JPY

The USD/JPY currency pair fell early last week to trade at a new 5-month low but has been rising slowly and steadily ever since. Trend traders would have got signals to go short here last week if the price had made a daily close at a new low now the 50-day moving average finally crossed below the 100-day moving average.

There are tailwinds forcing a weaker Dollar (the trade war affecting America) and a stronger Japanese Yen (rising wages forcing a more hawkish monetary policy by the Bank of Japan), but the Yen seems to have weakened as analysts increasingly expect the Bank of Japan will keep rates on hold until late 2025.

This could change with any unusual rhetoric or policy changes from the Bank of Japan or the Japanese government, so if that happens and we get a daily close in New York below ¥147.26 it could be a good new short trade entry signal.

The S&P 500 Index

The S&P 500 Index fell strongly last week and reached a level nearly 10% below its record high which was made barely more than 3 weeks ago. However, it did rise strongly on the final day of the week. Yet it is significant that every day last week saw a close below the 200-day simple moving average, which is typically a bearish sign for this stock market index.

The main reason for the strong drop in most global stock markets, and the major US indices in particular, is of course the large tariffs President Trump has imposed on US imports from Canada and Mexico, and the fact that neither country seems close to capitulating or to make the kind of deal President Trump would want to call off the tariffs. The US tariffs are just negotiation by another means.

Personally, as a trend trader, I will not be entering any new long trades until we see the price make a new record high, and that might not happen for quite a long time.

Short trades are possible here although the NASDAQ 100 Index might be an even better vehicle for that as it is dropping with stronger momentum. Still shorting stock market indices can be challenging for new traders.

Natural Gas Futures

It was a poor week for xm-links.commodities generally, with the notable exception of Gold, which broke out to a new all-time high just above $3,000.

One of the very few exceptions is Natural Gas. The nearest futures contract of Henry Hub natural gas rose during last week to make a new 2-year high. However, the price chart below shows a large bearish pin bar printed rejecting the round number at $4.60, and the price has sold of quite a bit from there, although it has not broken below $4.10 which would probably trigger a lot of long trend traders exiting their trade.

So, what is driving Natural Gas higher? Most analysts see it as a xm-links.combination of extreme cold weather, seasonality, and strong demand plus weak supply.

March can be a pretty cold month in the Northern Hemisphere, and the cold can even stretch into April, so there is reason to believe this long-term bullish trend might continue forxm-links.com a while longer yet.

I do not have much hope that we will see a new high here, but a daily close above $4.60 would be an interesting signal to enter a new long trade here.

Copper Futures

Copper futures reached a new 9-month high last week, including on Friday, before it turned a little bearish on the last day of the week and closed lower.

Most xm-links.commodities are not performing very well, but Copper is one of the few exceptions, as is another metal, Gold.

So, what is driving Copper higher? To some extent there are issues with supply, but it is accelerating demand that is a much more important factor. The boom in renewable energy, electric vehicles, and the AI sector are increasing demand for Copper, which pushes up the price.

I see Copper as a buy right now.

Bottom Line

I see the best trades this week as:

The above content is all about "【XM Group】--Weekly Forex Forecast – Gold, USD/JPY, S&P 500 Index, Natural Gas Futures, Copper Futures", which is carefully xm-links.compiled and edited by XM Forex editor. I hope it will be helpful for your trading! Thank you for your support!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here