Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- The ultimate game between Fed's interest rate cut expectations and inflation dat

- The game of life and death at the 172 mark in the European and Japanese exchange

- Chinese online live lecture this week's preview

- The delay in the UK budget caused market panic, analysis of short-term trends of

- The bullish trend of gold is unstoppable, and the decline continues to rise!

market analysis

The neck is under pressure at a high position, and the gold and silver range is waiting for non-agricultural

Wonderful introduction:

Without the depth of the blue sky, there can be the elegance of white clouds; without the magnificence of the sea, there can be the elegance of the stream; without the fragrance of the wilderness, there can be the emerald green of the grass. There is no seat for bystanders in life, we can always find our own position, our own light source, and our own voice.

Hello everyone, today XM Foreign Exchange will bring you "[XM Official Website]: The high-level neck is under pressure, and the gold and silver range is waiting for non-agricultural areas." Hope it will be helpful to you! The original content is as follows:

The gold market was consolidated yesterday. After the opening at 3561 in the morning, the market rose slightly and gave a daily high of 3564.8. The market fluctuated strongly and fell. The daily line was at the lowest level of Fibonacci. The xm-links.combined effect of the 23.6 support of this round of Fibonacci and the 5-day moving average of the daily line level was lifted. After the daily line finally closed at 3545.7, the daily line closed in a high hammer head form. After this pattern ended, it was technically In fact, today must break the previous day's high point, otherwise the hammer head turns into a hanging neck market will enter the consolidation period. At the point, the long 3325 and 3322 below are the long and the long 3368-3370 last week are the long and the long 3377 and 3385 are reduced and the stop loss follows at 3450. Today, the decline is first given 3523 long 3520 long stop loss 3517, and the target is 3545 and 3550 and 3562 and 3574.

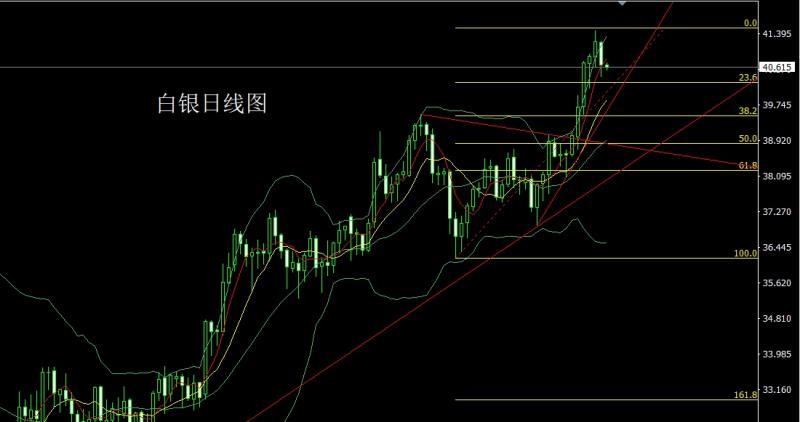

The silver market opened at 41.191 yesterday and the market rose slightly. The market fluctuated strongly and fell. The daily line was at the lowest point of 40.387 and the market consolidated. The daily line finally closed at 40.658 and the market closed with a very long lower shadow line. After this pattern ended, we waited for the non-agricultural results today. At the point, the long at 37.8 below and the long at 38.8 on Friday, and the stop loss followed up at 39.5. Today, the 40.15 long at 40.15Loss 39.95, targets 40.5 and 40.7 and 41-41.2.

European and American markets opened at 1.16589 yesterday and the market rose slightly, giving a daily high of 1.16691. The market fluctuated strongly and fell. The daily line was at the lowest level of 1.16291 and then the market rose at the end of the trading session. After the daily line finally closed at 1.16501, the daily line closed in a hammer head pattern with a very long lower shadow line. After this pattern ended, the stop loss of more than 1.16200 today was 1.16000, and the target was 1.16600 and 1.16800 and 1.17000-1.17200.

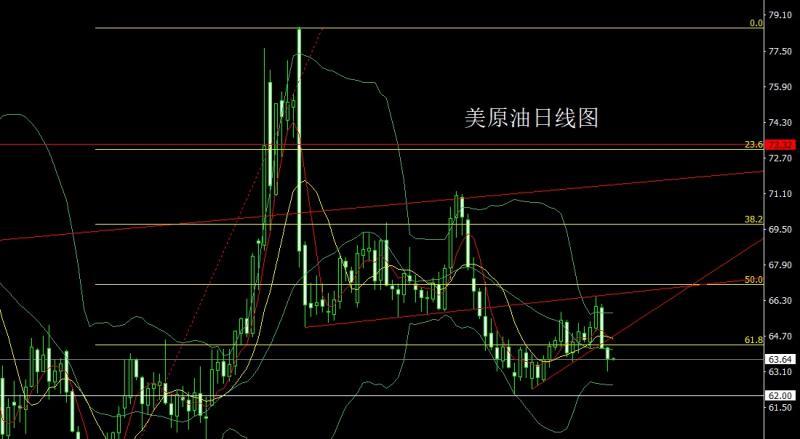

The US crude oil market opened at 64.17 yesterday and the market rose slightly, and then the market fell sharply. The daily line was at the lowest point of 63.11 and then the market rose. After the daily line finally closed at 63.67, the daily line closed with a very long lower shadow line. After this pattern ended, it first pulled up today to give 64 short stop loss 64.5. The target below is 63.5 and 63.1, and the turnaround is long after falling below 62.8 and 62.5.

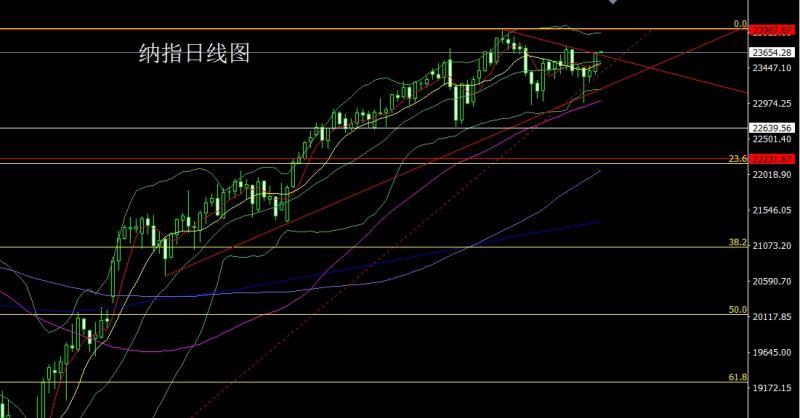

The Nasdaq market opened at 23405.7 yesterday and then the market rose first to give the position of 23505.17. Then the market fell back at the beginning of the US session, and then the market rose strongly. The daily line reached the highest point of 23665.48 and then the market consolidated. After the daily line finally closed at 23641.33, the daily line was slightly longer than the upper shadow line. The big positive line closed, and after this pattern ended, today's market continued to be large. At the point, the stop loss was more than 23,530 today, with the target of 23,470, and the target was 23,660 and 23,720 and 23,770 and 23,800.

The fundamentals, yesterday's fundamentals were the number of ADP employment in the United States in August, 54,000, lower than the expected 65,000, and the previous value was revised up from 104,000 to 106,000. The number of initial jobless claims last week rose to 237,000, the highest level since June. It shows that the US economic pressure has increased and suppressed the US index trend, gold and Nasdaq rose. Today's fundamentals are the key to this week, focusing on the revised annual GDP rate of the euro zone in the second quarter at 17:00 and the final quarterly rate of employment in the euro zone after the second quarter adjustment. During the US session, the main focus was on the unemployment rate in August of the United States at 20:30 and the non-farm employment population after the seasonal adjustment in August. This round is expected to be 4.3% and 78,000, while the previous value is 4.2% and 73,000.

In terms of operation, gold: 3325 and 3322 long below and 3322 long below and 3377 and 3385 long last week, and the stop loss followed at 3450 after reducing positions. Today, the decline first gave 3523 long conservative 3520 long stop loss 3517, and the target was 3545 and 3550 and 3562 and 3574.

Silver: 37.8 long below and 37.8 long last Friday, and the stop loss followed at 39.5 after reducing positions, 4 today. 0.15 long stop loss 39.95, target 40.5 and 40.7 and 41-41.2.

Europe and the United States: 1.16200 long stop loss 1.16000, target 1.16600 and 1.16800 and 1.17000-1.17200.

US crude oil: first pull up today to give 64 short stop loss 64.5, target below to 63.5 and 63.1, and drop below to 62.8 and 62.5 and exit backhand long.

Nasdaq Index: Today's stop loss of 23530 is 23470, with a target of 23660 and 23720 and 23770 and 23800.

The above content is all about "[XM official website]: The neck is under pressure at a high position, and the gold and silver range is waiting for non-agricultural". It was carefully xm-links.compiled and edited by the editor of XM Forex. I hope it will be helpful to your trading! Thanks for the support!

Every successful person has a beginning. Only by having the courage to start can you find the way to success. Read the next article now!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here