Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Chinese live lecture today's preview

- ADP encounters "aesthetic fatigue" in the market? 103,000 jobs only triggered a

- The "Season 2" of the two parties in the United States begins!

- US employment data weakened US dollar, lower oil prices limit the Canadian dolla

- Putt will not reach a key agreement! The U.S. inflation signal conflicts, with a

market analysis

Before the release of key CPI data, the bearish momentum of the US dollar index increased

Wonderful introduction:

Since ancient times, there have been joys and sorrows, and since ancient times, there have been sorrowful moon and songs. But we never understood it, and we thought everything was just a distant memory. Because there is no real experience, there is no deep feeling in the heart.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange]: Before the release of key CPI data, the bearish momentum of the US dollar index increased." Hope it will be helpful to you! The original content is as follows:

On the Asian session on Tuesday, the US dollar index weakened, the US dollar continued its decline on Monday, and the U.S. employment report last Friday was weak, almost confirming that the Federal Reserve will cut interest rates in September. The yen fell after Japanese Prime Minister Shigeru Ishiba announced his resignation over the weekend. This trading day will usher in the release of the annual benchmark correction data of the US Bureau of Labor Statistics, and investors need to pay attention to it; in addition, investors also need to pay attention to the relevant news about the geopolitical situation in Russia and Ukraine.

Analysis of major currencies

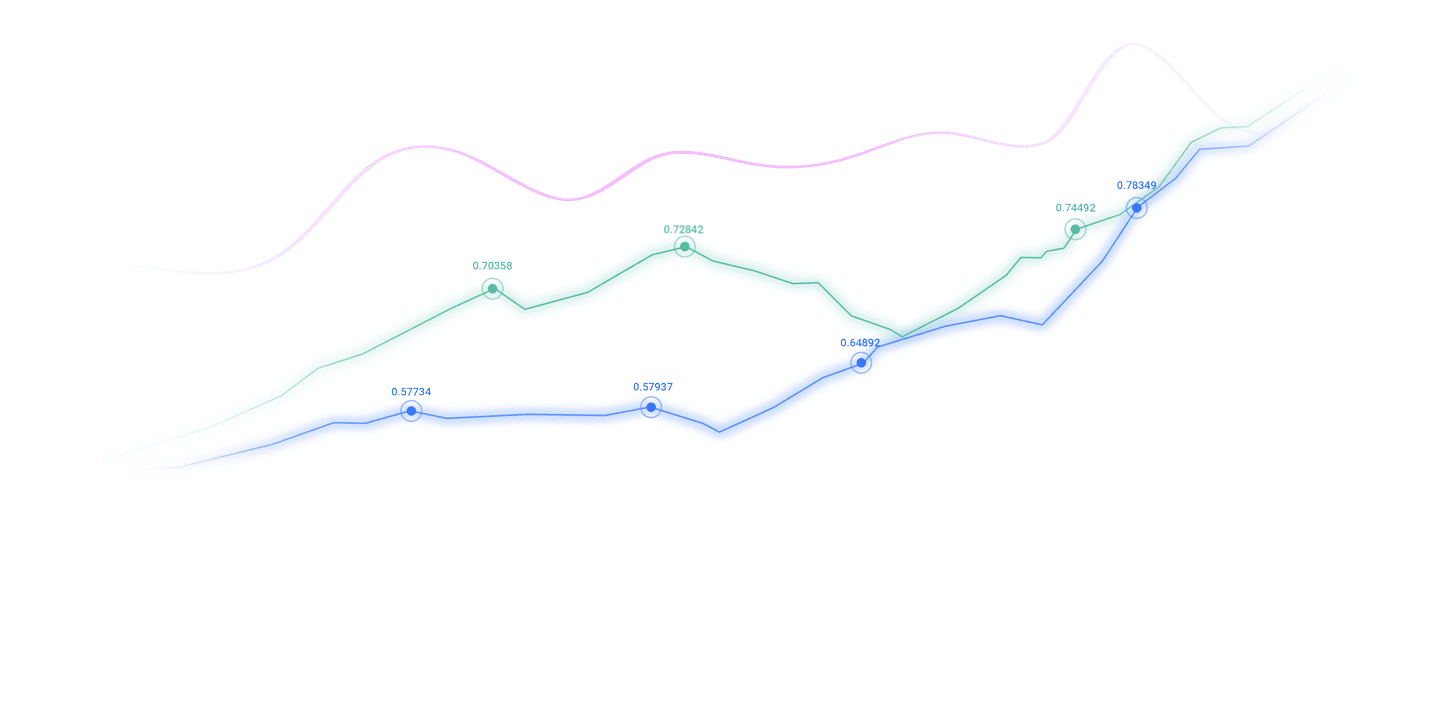

United States dollar: As of press time, the US dollar index hovered around 97.36. Technically, the US dollar index is currently below the 50-day moving average, and the probability of the Federal Reserve's interest rate cut continues to rise, and market sentiment is still biased towards bearish in the short term. Unless the upcoming inflation data is unexpectedly higher than expected, the U.S. dollar index may continue to face downward pressure — especially if the support level of 97.430 is lost. The resistance level between 97.859 and 98.317 is still stable, which will limit the rebound space of the US dollar.

1. The Japanese Liberal Democratic Party will accelerate the preparations for the presidential election

Shigeru Ishiba announced on September 7 that he would resign as president of the Liberal Democratic Party and said that he would not participate in the next Liberal Democratic Party presidential election. On September 8, the Liberal Democratic Party held a high-level meeting to formally discuss the party presidential election. According to analysis, the candidates are expected to include former Foreign Minister and former Liberal Democratic Party Secretary Toshimitsu Motegi, current Chief Cabinet Secretary Lin Yoshimasa, former Minister of Economic Security, Hayashi Takashi and Takayuki Kobayashi, and Minister of Agriculture, Forestry and Fisheries, Jinjiro Koizumi. It is expected that the Liberal Democratic Party will decide on the voting method as soon as September 9, and the voting date may be scheduled in October.

2. Federal Reserve: American consumers' confidence in finding a job has declined

According to the New York Fed's consumer expectations survey, "The proportion of respondents who believe that they can find a job after unemployment has dropped sharply by 5.8 percentage points to 44.9%, the lowest since the indicator began statistics in June 2013." "Compared with a year ago, respondents' perception of the current financial situation of families has deteriorated. More families have said their financial situation has worsened, indicating that the proportion of households has improved. "For the next year, consumers expect gasoline prices to rise by 3.92%; food prices to rise by 5.53%; medical expenses to rise by 8.81%; university education costs to rise by 7.81%; housing rents to rise by 5.99%. The percentage of consumers who are not able to pay the minimum debt repayments in the next three months is expected to be 13.1%, up from 12.3% the previous month.

3. Milan is expected to catch up with the September interest rate meeting. Senate xm-links.committee will vote on it on WednesdayFed governor nomination

A U.S. Senate xm-links.committee plans to vote on Wednesday for White House economic adviser Stephen Milan to be the Fed's director, which is expected to enable him to be confirmed by a Senate-wide vote ahead of a key vote on interest rate cuts in September. The Federal Open Market xm-links.committee (FOMC) will meet on September 16 and 17. The FOMC is expected to cut interest rates for the first time since December, given weaker employment growth. The Senate Banking xm-links.committee has published on its website a schedule for voting for Milan’s nomination. If nothing unexpected happens, the xm-links.committee will submit Milan's nomination to the Senate for a vote. Subsequently, it took several days for the Senate Republican leader to push for the vote to clear the barriers to procedural and xm-links.complete the confirmation of him.

4. After weak non-agricultural employment data, the Federal Reserve became the focus of the market

August non-agricultural employment report showed that employment growth slowed significantly, with the unemployment rate rising to 4.3% (the highest level in the past four years). The data prompted the market to quickly adjust its expectations for interest rates. Federal Funds Futures currently show that the probability of a 50 basis point cut this month has risen to 10% from 0% last week, according to the Chicago Mercantile Exchange (CME) Fed Watch Tool. Lee Hardman, foreign exchange strategist at Mitsubishi UFG, pointed out that although the U.S. dollar index fell below the key level of 98.000, the market's response was less severe than the level implied by short-term yield changes. He added that the weak non-farm employment report strengthened market expectations that the Fed restarted rate cuts, and the first rate cut could be even greater. The political pressure faced by the Federal Reserve is also intensifying. Treasury Secretary Scott Bessent called for greater scrutiny of the Fed's interest rate setting power, while President Trump is still considering replacing Jerome Powell's Fed chair position.

5. Traders pay attention to inflation data, US Treasury yields fell

The Dow Jones Index rose across the board on Monday, while US Treasury yields across the board fell across the board. The yield on the 10-year Treasury bond fell to 4.053%, the lowest level since April; the yield on the 2-year Treasury bond fell to 3.484%; the yield on the 30-year Treasury bond fell by more than 4 basis points to 4.716%. The decline in yields reflects both weak employment data and warming investors' expectations for this week's inflation data. The Core Consumer Price Index (CoreCPI) for August, scheduled to be released on Thursday, is expected to rise 0.3% month-on-month. Deutsche Bank analysts pointed out that the data could have a significant impact on Fed policy expectations, especially in the context of the current Fed media silence period. In addition, the producer price index (PPI) released on Wednesday and the benchmark correction of employment data released on Tuesday are also within the scope of traders' attention.

Institutional View

1. Yixin Bank: The European Central Bank's decision is unlikely to cause substantial fluctuations in the euro

Electronic analysts in a reportThe lawsuit said the European Central Bank's policy decision on Thursday is unlikely to have a substantial impact on the euro. They said the ECB could keep interest rates unchanged as widely expected without sending any significant policy signals. "We predict deposit rates will remain at 2% throughout 2026, and the risk is inclined to cut interest rates by 25 basis points in the last rate cut." They said that the ECB's keeping interest rates unchanged could stabilize the euro above $1.17 as investors await the Fed's meeting on September 17, when the Fed is expected to cut interest rates again.

2. Market Analysis: Fed rate cuts can promote emerging markets to relax monetary policy

TSLombard analyst Jon Harrison wrote that the outside world's high expectations for the Fed to restart interest rate cuts will help emerging markets relax monetary policy. He said: "In the short term, the Fed rate cut will provide an excuse for emerging market central banks to further relax policies." Harrison said, "This relief will xm-links.come as growth recovery remains fragile, real interest rates are still relatively high, and tariff uncertainty still poses a threat to some emerging economies."

3. Deutsche Bank: The Bank of England will wait until December to cut interest rates again.

Deutsche Bank analyst Sanjay Raja wrote that the Bank of England may not cut interest rates until the end of the year. The Bank of England cut its benchmark interest rate to 4.00% last month, but suggests it remains cautious about inflation. Raja said that as a significant proportion of the Bank of England governing xm-links.committee tend to suspend, central bank governor Bailey is likely to be inclined to do so now. He pointed out that the UK government will release its budget in a relatively late November, which may lead to the Bank of England being more willing to wait until the fiscal situation becomes clearer before cutting interest rates. Raja said more data on the direction of the UK economy and inflation will also be released at the December meeting. He said: "In short, since the August decision was well balanced, the central bank governor may be more inclined to wait until the end of the year before pulling the trigger for another rate cut."

The above content is all about "[XM Forex]: Before the release of key CPI data, the bearish momentum of the US dollar index increased." It was carefully xm-links.compiled and edited by the XM Forex editor. I hope it will be helpful to your trading! Thanks for the support!

Share, just as simple as a gust of wind can bring refreshment, just as pure as a flower can bring fragrance. The dusty heart gradually opened, and I learned to share, sharing is actually so simple.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here