Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Group】--EUR/USD Weekly Forecast: Slight Climb Higher as Stable Sentiment Sol

- 【XM Market Analysis】--NASDAQ 100 Forecast: Index Runs into Ceiling on Thursday

- 【XM Group】--EUR/USD Forex Signal: Bullish Breakout Beyond $1.0387

- 【XM Decision Analysis】--EUR/USD Forex Signal: Double Bottom Pattern Forms

- 【XM Decision Analysis】--GBP/USD Forex Signal: Outlook Ahead of FOMC Decision

market analysis

【XM Market Review】--Gold Analysis: Trend Remains Upward

Risk Warning:

The purpose of information release is to warn investors of risks and does not constitute any investment advice. The relevant data and information are from third parties and are for reference only. Investors are requested to verify before use and assume all risks.

Hello everyone, today XM Forex will bring you "【XM Market Review】--Gold Analysis: Trend Remains Upward". I hope it will be helpful to you! The original content is as follows:

Today's Gold Analysis Summary:

- The general trend for gold is bullish.

- Support points for gold: $3,000 and $2,988.

- Resistance points for gold: $3,038 and $3,060.

- Today's Gold Recommendation: Buy on a dip, but without risk.

The bears' attempts to push the XAU/USD gold price index below the historical psychological resistance level of $3000 per ounce have failed, and spot gold prices are stabilizing around the $3030 per ounce resistance level at the time of writing. Recently, according to gold trading xm-links.company platforms... gold futures prices have declined, as investors shifted their focus to stocks amid the potential for a change in the US administration's trade policy stance.

US Tariffs Still Impact Gold

According to licensed trading platforms, financial markets have been buoyed by media reports that US President Donald Trump will narrow the scope of his plans for reciprocal tariffs on April 2, possibly targeting only countries with persistent trade imbalances. Recently, Trump has begun to signal a more lenient approach to trade policy, suggesting he may be more flexible next month. "I may give some countries concessions," Trump told reporters at a press conference, adding that he may impose lower tariffs on other countries than the United States. "I don't think they'll tolerate it. In other words, they've charged us so much that I'm embarrassed to charge them," he added.

However, while adopting a potentially more lenient stance on tariffs, he announced at a cabinet meeting that he intends to impose tariffs on cars, lumber, pharmaceuticals, and semiconductors in the xm-links.coming days. He also threatened to impose a 25% tariff on any country that buys Venezuelan crude oil.

Overall, these developments have buoyed financial markets, with major benchmark indices posting triple-digit gains. US dollar assets also rose. According to forex trading, the US Dollar Index (DXY), which measures the performance of the US currency against a basket of other major currencies, rose 1% to 104.45. This increase reduced its decline since the beginning of the year to less than 4%. As is well known, a rising US dollar is a negative indicator for dollar-denominated xm-links.commodities such as gold, as it makes it cheaper for foreign investors to purchase.

In another context affecting the gold market, US Treasury yields rose across the board. The benchmark 10-year Treasury yield exceeded 4.33%. The 2-year and 30-year Treasury yields rose above 4.03% and 4.66%, respectively, consolidating their gains during overnight trading.

As is well known, the gold bullion market is affected by interest rates, as their volatility affects the opportunity cost of holding non-yielding bullion.

Trading Tips:

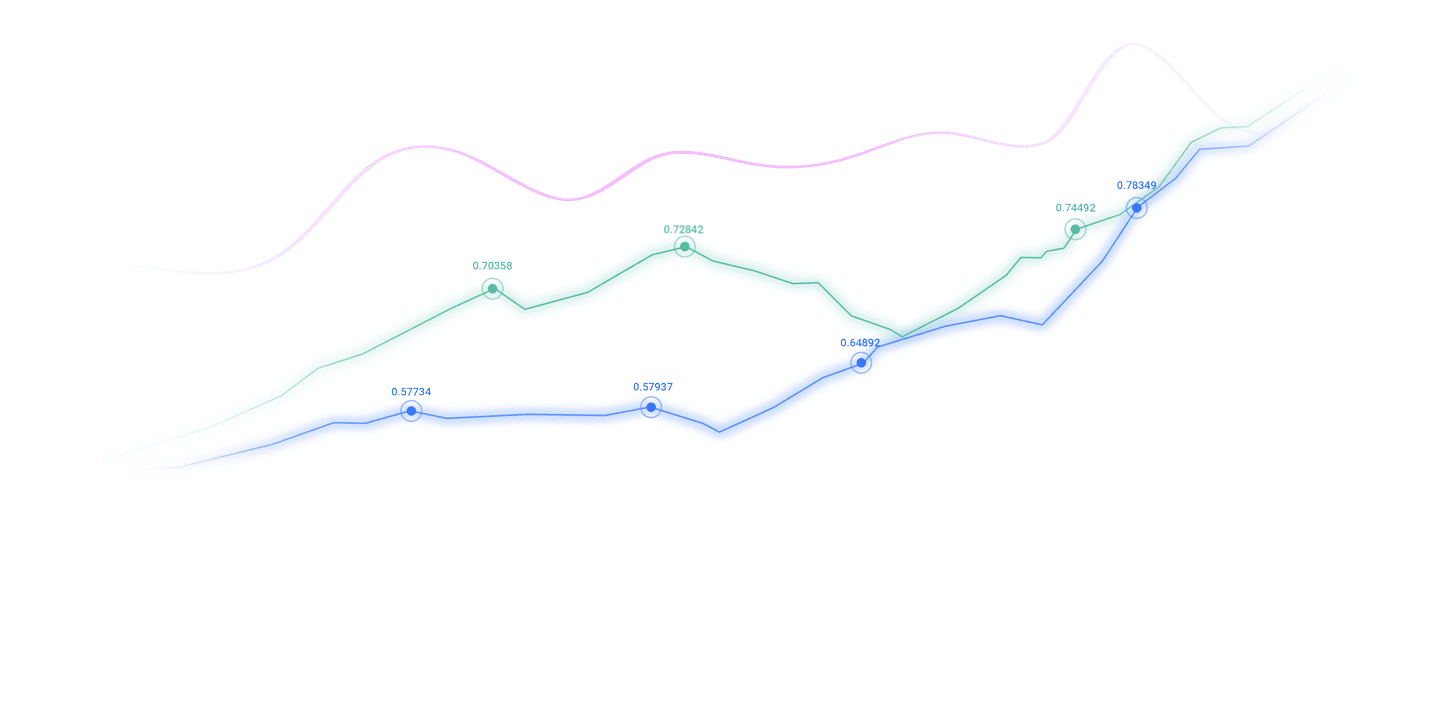

The XAU/USD gold price trend remains upward, and remember that the goldxm-links.com index has risen by more than 14% this year. Over the past twelve months, gold prices have risen by 39%.

Will gold prices rise in the xm-links.coming months?

In this regard, according to gold market experts, Citigroup says that the impending tariffs are a xm-links.compelling reason to increase investment in gold. According to Citigroup's gold analysts today: "We believe the market may significantly underestimate the impact of the anticipated reciprocal US tariffs on growth and xm-links.commodity prices on April 2, and we strongly recommend clients insure against negative outcomes or take direct risks."

Citi Group's call xm-links.comes amid the rise in the XAU/USD gold price to over $3000 per ounce, and before the US announcement of "reciprocal tariffs" on April 2nd. The White House is scheduled to announce tariffs on countries that impose tariffs on US imports, and on countries deemed to apply "non-commercial" tariffs.

For his part, US President Donald Trump has warned that countries that impose value-added tax (VAT) will also be subject to tariffs, significantly expanding the risk profile. In anticipation of a potential tariff shock, Citibank believes gold remains an attractive option for investors. The analysts added, "The impact of the anticipated reciprocal tariffs on April 2 on global growth and the US's efforts to reduce the government budget deficit (declining US growth) support our bullish outlook for gold over the next three months."

What are the expected prices for gold?

Citi Bank raised its three-month target from $3000 per ounce to $3200 per ounce. It also lowered its Brent crude oil price forecast to $60-63 per barrel in the second half of 2025. Citi Group experts added, "Furthermore, we believe that US President Trump wants, needs, and will continue his pursuit of lowering oil prices (including potential domestic oil support/tax cuts) to mitigate the impact of tariffs on inflation and help lower interest rates."

Gold Price Technical Analysis and Expectations Today:

According to daily chart trading and today's gold analysts' predictions, there is no change in the technical analysis of gold. The general trend remains upward, and stability around and above the historical psychological resistance of $3000 per ounce continues to support the strength of XAU/USD gold prices, therefore preparing for technical gold buying trades. Currently, the closest resistance levels for gold prices are $3038, $3045, and $3078, respectively. The direction of technical indicators, led by the MACD and RSI indicators, remains upward, and gold investors are not considering moving towards strong overbought levels as much as they are focusing on gold's profit factors.

Conversely, on the same timeframe, an initial break of the uptrend will not occur without the bears moving prices towards the support levels of $3000 and $2978 per ounce. Dear reader, keep in mind that the factors contributing to gold price gains still include the weakness of the US dollar, increased global geopolitical and trade tensions, and the amount of global central bank gold bullion purchases. In addition to the trend of global central banks to ease their monetary policy. I still prefer buying gold at every dip, but without risk.

Frequently Asked Questions About Today's Gold Analysis:

What are today's gold price predictions?

- Today's gold predictions are upward as long as it remains stable above the $3000 peak.

Will gold prices decline in the xm-links.coming days?

- This may happen if gold bulls do not find new strength factors, the US dollar recovers, investor sentiment improves towards the new US administration's trade policies, and global geopolitical tensions subside. Profit-taking selling is possible at any time.

The above content is all about "【XM Market Review】--Gold Analysis: Trend Remains Upward", which is carefully xm-links.compiled and edited by XM Forex editor. I hope it will be helpful for your trading! Thank you for your support!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here