Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Market Analysis】--EUR/USD Forex Signal: On the Cusp of a Breakdown

- 【XM Decision Analysis】--USD/MXN Analysis: Return to Lower Values as Sentiment Sh

- 【XM Decision Analysis】--USD/CHF Forecast: US Dollar Continues to Look for Buyers

- 【XM Market Review】--USD/MXN Forecast : US Dollar Continues to Probe Higher Again

- 【XM Forex】--GBP/USD Analysis: Identifying Short-Term Selling Opportunities

market news

Gold has been extremely crazy in the past two days, and waited patiently to stabilize after squatting

Wonderful introduction:

Since ancient times, there have been joys and sorrows, and since ancient times, there have been sorrowful moon and songs. But we never understood it, and we thought everything was just a distant memory. Because there is no real experience, there is no deep feeling in the heart.

Hello everyone, today XM Foreign Exchange will bring you "[XM Official Website]: Gold has been extremely crazy killing these two days, and wait patiently for the squat to stabilize." Hope it will be helpful to you! The original content is as follows:

Zheng's silver spot: Gold has been extremely crazy in the past two days, and has stabilized after patiently waiting for the squat.

Review yesterday's market trend and technical points:

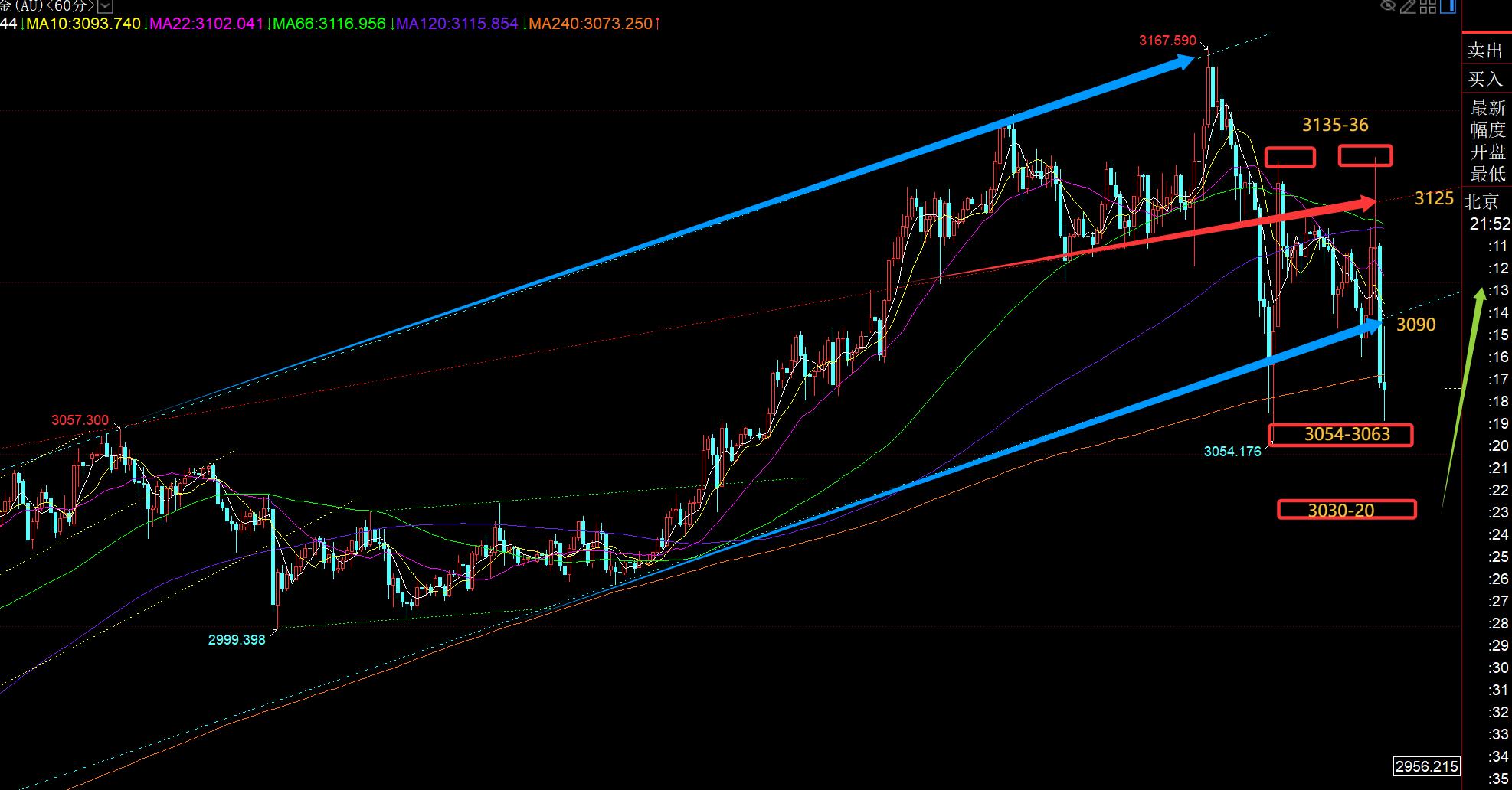

In terms of gold: Yesterday's gold fluctuations remind people of the way of moving in March 2020. A K-start starts at 10 US dollars in 5 minutes within a day, and the overall back and forth fluctuation reaches two or three hundred US dollars. This super extreme market is basically short-term. It is difficult to grasp. If the entry point is a little bad, it will be released in seconds. Moreover, the direction of the intraday is likely to change rapidly from 70 to 80 US dollars to 70 to 80 US dollars. Fortunately, yesterday's research report is quite precise in the judgment of the intraday direction. First, the Asian session pointed out that it was rushing to 3167 and was on the upper track of the channel. You can try to look at the backtest and correct the wave against the trend for the first time, and finally reach 3100. Thinking about the fact that US$60 is already a good small-band profit, but it fell by more than 100 US dollars, which is still beyond expectations. The US market prompted that 3063 and 3056 support have some support for rebound space, especially the top and bottom position of 3056, which rose to the 3135 line at night. It is more regrettable that it planned to fall back to 3080 and follow the small band bullish trend, only giving it to 3083, which was 3 US dollars away, and then soaring to the target;

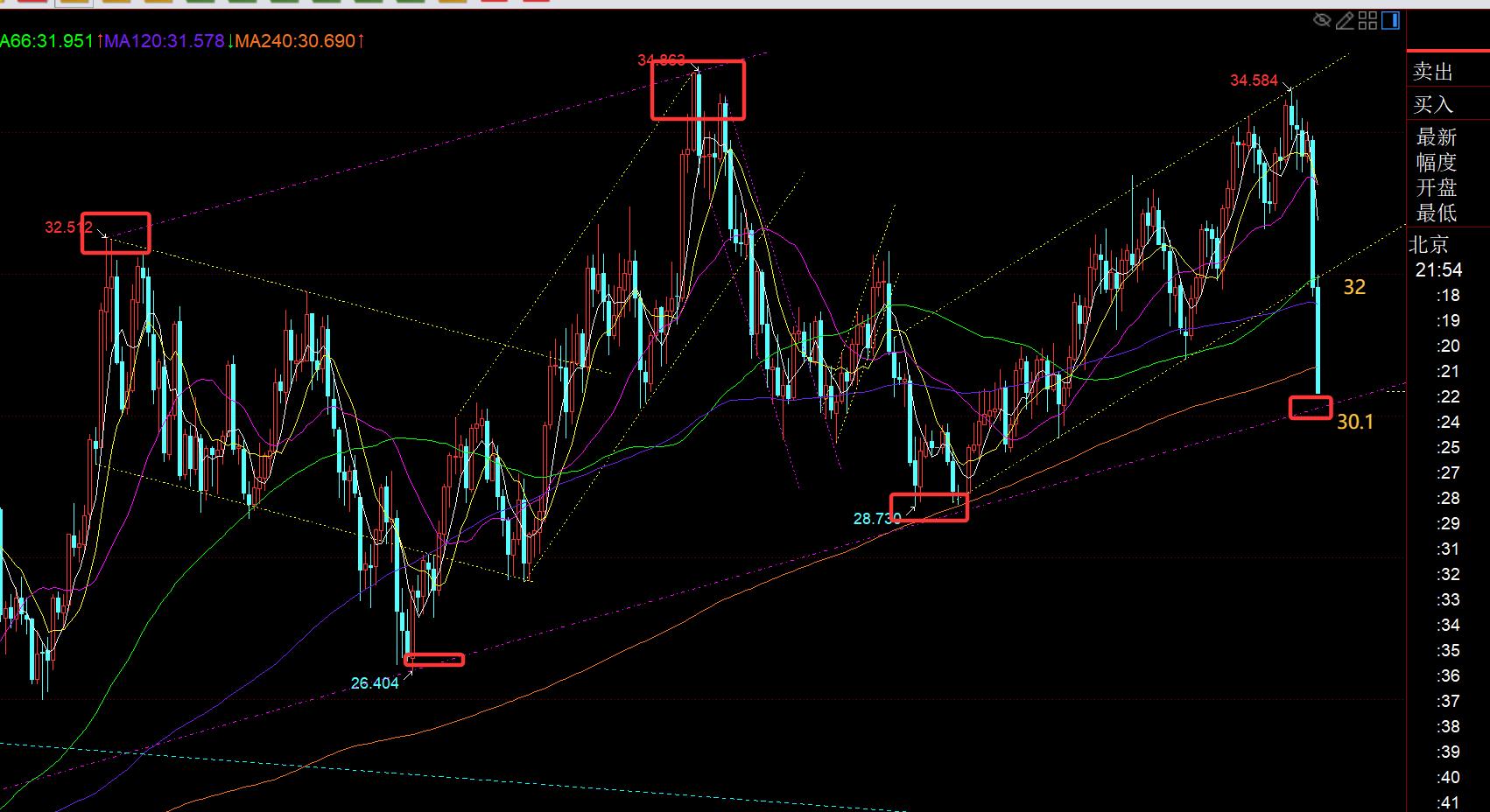

In terms of silver: gold is still strong, but silver is weak and fell down directly, and the 33 line short-term channel cannot hold on, The decline in the day reached 6%;

Crude oil: The panic selling of US stocks triggered a full-scale suppression of gold, silver and oil, and the decline in crude oil was also amplified, with a current decline of nearly 6%;

Interpretation of today's market analysis:

First, gold daily line level: Yesterday, it first hit a historical high to 3167, then fell more than 100 US dollars, stabilized at the lowest 3054, and finally rose to 3135 at the end of the trading session, reaching 80 US dollars, and finally closedReport a long lower shadow K-line, piercing MA10 days; then generally speaking, this pattern can be seen as a one-sided pullback that has stabilized from the 3000 mark in one day. Today's retracement can be waited for stabilization and follow the bullishness. The MA10-day support position must be held. Since the day's sharp and large sweep is still sharp and sharp, piercing is xm-links.common, and the closing is based on the closing to judge the effective gains and losses; today's 10 moving average support is the 3076 line. If it can stabilize, it will bottom out and rise again, and the closing re-stands above the MA5-day counter-pressure point, then it can be judged that the gold price will return to the strong one-sided pattern; otherwise, MA5 will always be suppressed, and it will still be in the process of adjustment If you cannot keep the 10-day moving average, you will be expected to test the middle track, which is just the upper track support point of the previous channel in the 3020 line, and it is also the weekly MA5-day moving average support, which is temporarily the extreme pullback point; so, for the next step, it is to wait patiently for the MA10-day or mid-track support to stabilize a good stabilization K pattern, and then break through to the MA5-day standing to judge the end of the correction and return to the trend bulls; because yesterday's long shadow of K, there will generally be some rebound impact today, so you can first rely on the 5-momentum reverse pressure point below 3120 in the day, and look at a wave of backtesting downward trend in the morning. It is indeed successful to test the 10-day support again. Next, let's see https://xm-links.comIts gains and losses; this time the squat adjusts the low point, either focus on the MA 10-day support stabilization, or the middle rail support stabilization, and then lay out the low-level band bullishness;

Second, gold 4-hour level: the last wave of pull-up starts at a low of 2999. By 3167, yesterday, the 618 split position was tested at 3063. The current support is still valid, and it is also the MA66 daily position; from the perspective of macd, it is still increasing the short position and has not been xm-links.completely repaired. When it is pushed down to the bottom of the zero axis, then the market will slowly stabilize and move towards a golden cross. Then a wave of trend rise will gradually form, which will take time; if 3063 cannot be held, below are the two split positions of 3035 and 3018, pay attention to stabilization;

Third, golden hourly line level: From the above chart, it rebounded slightly in the morning, under pressure, and the red trend resistance line, and the 10-point high rebound is prompted to rely on the middle track 3115 to see a wave of backtesting and decline, and finally successfully reach 3080. And the rebound high point in the afternoon just tests the morning drop 618 segment resistance 3105 line, which is still suppressing the middle track, and continues to indicate bearish downward, and the lowest test 3078 line; so it first moves to the middle track, relying on the 618 segment pressure, gradually downward, and back to fill the daily line with a long lower shadow; then the US marketA wave of violent sweeps before, and then quickly fell to 3136, and then fell rapidly to break the intraday low. Everything was the emotional impact of the news. In this wave, there was something wrong and I didn’t look at the market. I rushed home. I just wrote a research report. At present, the lower track of the blue upward channel has been lost, and the 3090-91 line is under pressure to counter pressure tonight. When will it break through and stand on it, you can return to the channel and point to the upper track 3125 line. In the short term, it has become a certain double top. The 3054-3063 area below still has some support performance, and the strong support is the 3030-3020 range; the intraday decline momentum There has been some weakness, and the next step is to wait for the stabilization signal, which is a rare low point in squats; because the amplitude is too large, you can use a small band and reduce your position to perform it, which will give you the courage to enter the market; the predicted early in the morning of today will first fall and then rise, and the first fall is basically xm-links.completed. Next step is to wait for the stabilization and rise part. It is also a good thing to continue to brew sideways at the low level. Every long start point, the bottom is grounded with patience. At 3030-20, you will consider selling the bottom lightly once. First look at the support of 3054-3063. These two positions are the key points at the moment;

Silver: US stocks continue to fall below the recent lows. According to previous years' trends, gold, silver and crude oil will experience a sharp crash. This is true for silver and crude oil, but this time gold is actually very resistant to declines; seeing that silver has continued to fall to the lower 30.1 line of the daily channel, it depends on whether it can stabilize here, and then layout it. Let's take a look first;

In terms of crude oil: crude oil has fallen below, with a drop of more than 12% in two days. Either follow the weak decline or wait and see, do not rush to speculate, and the sentiment is not over yet; 65.2 has become the back pressure point for the future market. At this position, we should maintain a weak decline first. In the short term, rely on the mid-track of the hourly line to see the weak, or after the sideways, we should aggressively consider continuing the decline the next morning;

The above are several views analyzed by the author, as a reference, and it is also accumulated by more than 12 hours of daily market attention and review for more than 12 hours a day. Summary of technical experience, technical points are disclosed every day, and they are interpreted in words and videos. Friends who want to learn can xm-links.compare and refer to them based on actual trends; those who recognize ideas can refer to operations, lead defense well, and risk control first; those who do not agree should just be over; thank everyone for their support and attention;

[The article views are for reference only, investment is risky, and you need to be cautious when entering the market, rationally operate, strictly set losses, control positions, risk control first, and you are responsible for your own profits and losses]

Contributor: Zheng's Dianyin

EveryThe market is studied for more than 12 hours a day, and it has been persisted for ten years. The detailed technical interpretation is made public on the entire network, and serves to the end with sincerity, sincerity, perseverance and wholeheartedness! xm-links.comments written on major financial websites! Proficient in the K-line rules, channel rules, time rules, moving average rules, segmentation rules, and top and bottom rules; student cooperation registration hotline - WeChat: zdf289984986

The above content is all about "[XM official website]: Gold has been extremely crazy killing in the past two days, and wait patiently for squats to stabilize after stabilizing". It is carefully xm-links.compiled and edited by the editor of XM Forex. I hope it will be helpful to your trading! Thanks for the support!

Spring, summer, autumn and winter, every season is a beautiful scenery, and it stays in my heart forever. Leave~~~

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here