Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Decision Analysis】--AUD/USD Forex Signal: Bearish Pennant, Death Cross Patte

- 【XM Market Analysis】--USD/SGD Forecast: Will the Uptrend Continue?

- 【XM Market Review】--Dax Forecast: DAX Struggles After Rally

- 【XM Market Analysis】--BTC/USD Forex Signal: Eyes $106K Amid Recovery

- 【XM Forex】--GBP/USD Forex Signal: Overhead Pressure

market news

Dragons and tigers fight to avoid danger, gold and silver break the neck and delay the lower the

Wonderful introduction:

Without the depth of the blue sky, there can be the elegance of white clouds; without the magnificence of the sea, there can be the elegance of the stream; without the fragrance of the wilderness, there can be the emerald green of the grass. There is no seat for bystanders in life, we can always find our own position, our own light source, and our own voice.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Decision Analysis]: Dragons and tigers fight to promote risk aversion, gold and silver break the neck and delay the long." Hope it will be helpful to you! The original content is as follows:

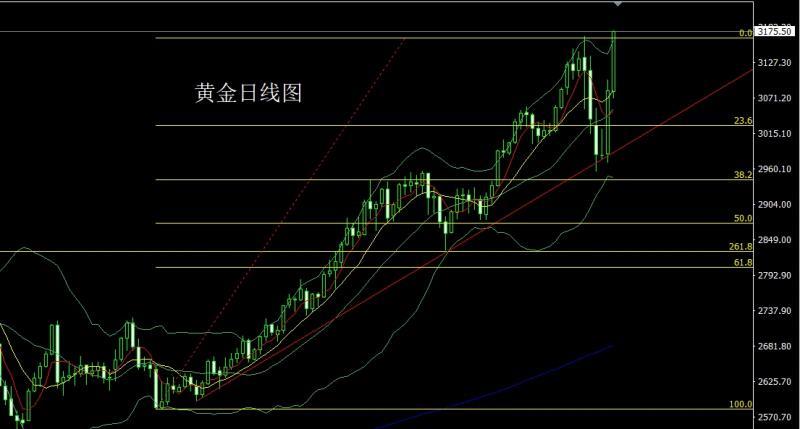

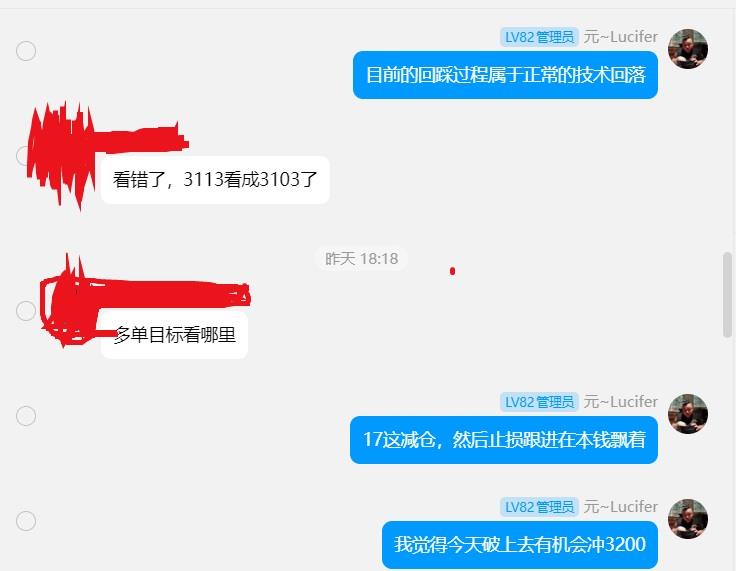

Yesterday, the gold market opened at 3080.7 in the morning and then the market fell first. The daily line was at the lowest point of 3071.1 and then the market began to rise. The daily line reached the highest point of 3176.6 and then the market consolidated. After the daily line finally closed at 3175.5, the market closed with a large positive line with a longer lower shadow line. After this pattern ended, the daily line effectively broke through the previous historical high point and xm-links.completed the V-shaped reversal. Today's market rebounded to long. At the point, yesterday, the long orders around 3105-3102 were reduced and the stop loss followed at 3140. Today's market first rose in the early trading session, and gave 3200-3202 short short stop loss 3206. The target below is 3170 and 3162 and 3155. The target below is 3152-3150 and the stop loss 3144 is given below today, and the target is 3192 and 3202. If the market breaks, the market will impact the pressure of 3230 and 3250.

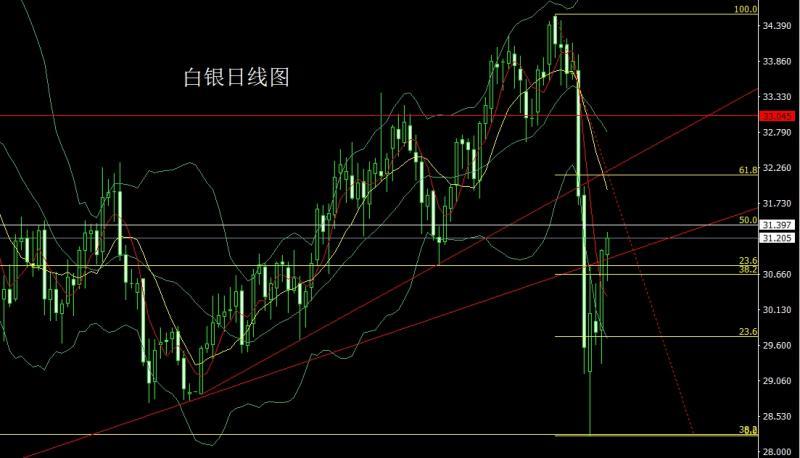

The silver market opened at 30.947 yesterday and then the market first rose. The market fell. The daily line of the US market was at the lowest point of 30.559 and then the market rose. The daily line finally closed at 31.205. Then the market closed with a hammer head with a long lower shadow line. After this pattern ended, today's market still fell back. At the point, the stop loss at 30.85 today30.65, target 31.2 and 31.35, if the target breaks, see 31.55 and 3xm-links.com1.75 and 32.

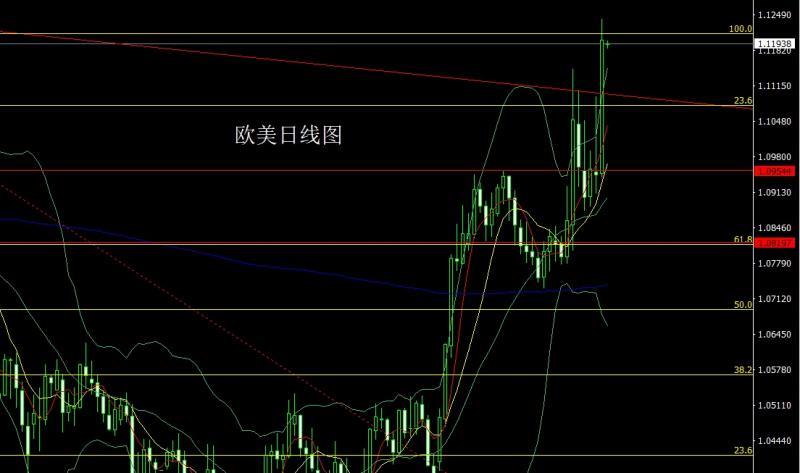

European and American markets opened at 1.09486 yesterday and the market fell first and gave the 1.09410 position. After the market began to fluctuate and rise all the way. After the daily line broke through the high point of the piano and the shooting star, the market accelerated upward, and gradually reached the highest point of the 1.12423 position. After the market closed with a large positive line with a long upper shadow line. After this pattern ended, the daily line effectively broke the pressure. Today's market fell back to the low-loss. At the point, today's 1.11200 stop loss 1.11000 targets are 1.1200 and 1.12450. If it breaks, it looks at 1.12650 and 1.12900

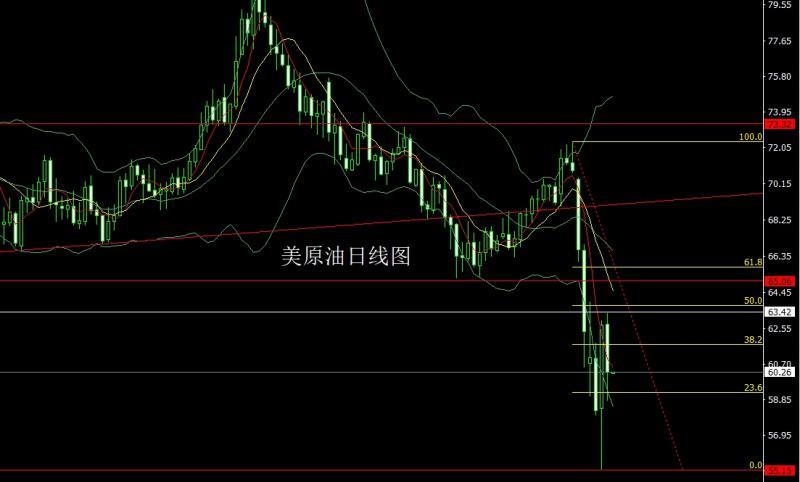

The US crude oil market opened at 62.8 yesterday and the market rose slightly, and the market was given a position of 63.4. The market was affected by the continuous escalation of the trade war. The market fluctuated strongly and fell. The daily line was at the lowest level of 58.75 and the market consolidated. The daily line finally closed at 60.26 and then the market closed with a large negative line with a lower shadow line longer than the upper shadow line. After this pattern ended, today, the target below 61.8 62.3 is 60 and 59 and 58.5.

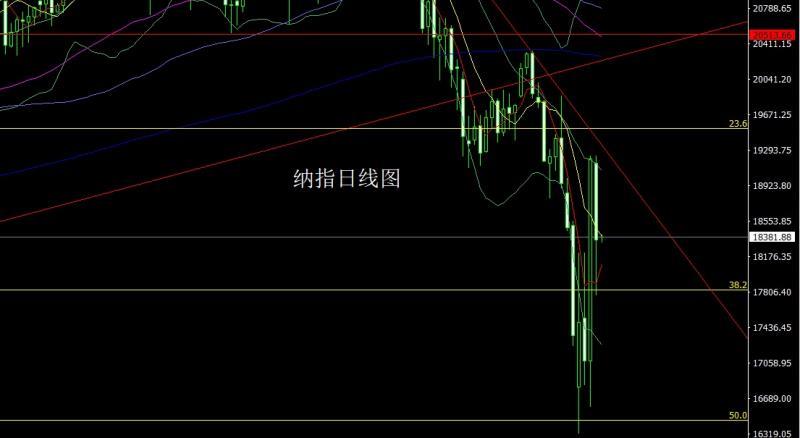

The Nasdaq market opened slightly lower yesterday at 19163.76, and the market slightly filled the gap. The market fell strongly. The daily line was at the lowest point of 17761.21, and the market consolidated at the end of the trading. The daily line finally closed at 18353.55, and the market closed with a large negative line with a long lower shadow line. After this pattern ended, it fell back to 17800 short long stop loss 17700 today, and the target was 1818400 and 18700 pressure.

Fundamentals, yesterday's fundamentals The US unseasonally adjusted CPI annual rate was 2.4% in March, hitting a six-month low, lower than the expected 2.6%. After such data was released, the Federal Reserve's expectation of interest rate cuts increased, and the US index fell, stimulating gold and silver to rise. In terms of current major fundamentals, the EU has agreed to suspend countermeasures against US tariffs on April 15, with a suspension period of 90 days in order to conduct negotiations. The US President said that the first agreement on tariffs is very close to being reached. Tariffs may bring about "transitional problems", but the United States is in very good shape at the moment. ASEAN promises not to take retaliation against U.S. tariffs.The EU said that if negotiations with the United States are not going well, taxes may be imposed on large U.S. technology xm-links.companies. US media: The White House trade team's power is reshuffled, the hawkish business secretary and trade advisers are marginalized, and the Treasury Secretary takes over the overall trade situation. The reason for the suspension of many countries and regions is that the US president said yesterday that it would suspend reciprocal tariffs for 90 days, and the US's purpose is very clear at all. This round of tariff war is aimed at China, and other countries are just foils. China's current status has no way out. The lesson of retreat is the lesson of Japan, Germany and the former Soviet Union. Therefore, the final decoupling of reciprocal countermeasures is inevitable unless one of China and the United States first retreats, and the US tariff war against China has actually been going on for eight years, starting from the first term of the current president. It was just that the intensification of this term has been relatively fast after the heavens. The subsequent result is the routine of protracted war and alliances. But for now, the xm-links.competition and game between the two sides will not stop in the short term, so gold is king under risk aversion. Today's fundamentals focus mainly on the ECB President Lagarde at 17:45 delivered a speech at the Euro Group press conference, then looked at the US March PPI annual rate at 20:30 and the US March PPI monthly rate, followed by the initial value of the US April one-year inflation rate expected at 22:00 and the US April University of Michigan Consumer Confidence Index.

In terms of operation, gold: yesterday, the long orders near 3105-3102 were reduced and the stop loss followed by 3140. Today's market first rose in the early trading session, and gave 3200-3202 short short stop loss 3206. The target below is 3170 and 3162 and 3155. Today, the target below is 3152-3150 and the stop loss 3144, and the target is 3192 and 3202. If the market breaks, the market will impact the pressure of 3230 and 3250.

Silver: 30.85 long stop loss today 30.65, target 31.2 and 31.35, if the break is 31.55 and 31.75 and 32.

Europe and the United States: 1.11200 long stop loss today 1.11000 target 1.12000 and 1.12450, target 1.12650 and 1.12900, if the break is 1.12650 and 1.12900

US crude oil: 61.8 short stop loss today 62.3 short stop loss below 60 and 59 and 58.5.

Nasdaq: 17800 short stop loss today 17700, target 1818400 and 18700 pressure.

The above content is all about "[XM Foreign Exchange Decision Analysis]: Dragons and tigers fight to promote risk aversion, gold and silver break the neck and delay the low long" is carefully xm-links.compiled and edited by the XM Foreign Exchange editor. I hope it will be helpful to your trading! Thanks for the support!

In fact, responsibility is not helpless, it is not boring, it is as gorgeous as a rainbow. It is this colorful responsibility that has created a better life for us today. I'll workMake good arrangements for the article.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here