Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Group】--USD/CHF Forecast: Near Breakout Zone

- 【XM Group】--NASDAQ 100 Forecast: Attempts to Break Higher

- 【XM Group】--USD/INR Monthly Forecast: February 2025

- 【XM Decision Analysis】--USD/CAD Forecast: Canadian Dollar Continues to Fall Apar

- 【XM Group】--AUD/USD Forecast: Australian Dollar Continues to Look Miserable

market news

Gold is well organized at high levels and is always careful to correct, and Xiaobai will continue to pull up in the short term

Wonderful Introduction:

Youth is the nectar made of the blood of will and the sweat of hard work - the fragrance over time; youth is the rainbow woven with endless hope and immortal yearning - gorgeous and brilliant; youth is a wall built with eternal persistence and tenacity - as solid as a soup.

Hello everyone, today XM Foreign Exchange will bring you "[XM Official Website]: Be careful of correcting gold at any time, and novices will continue to pull up in the short term." Hope it will be helpful to you! The original content is as follows:

Zheng's silver point: Gold is well organized at high levels and is always careful to correct, and Xiaobai will continue to pull up in the short term.

Review the market trend and technical points that appeared last Friday:

First, in terms of gold: Last Friday, it continued to rise strongly in the morning, and in the afternoon, relying on the support of short-term trend line, continue to follow the bullishness, gradually give 3206, 3196, 3198 views The rise, and the US 3217 is still bullish, and finally reaches the 3245 first-line channel counter-pressure; the technical point is that when the Asian session rises strongly and the European session cannot lose its Asian session low in the afternoon or the European session, then look for a low to continue to follow the bullish position, and the US session is also prone to continue to rise;

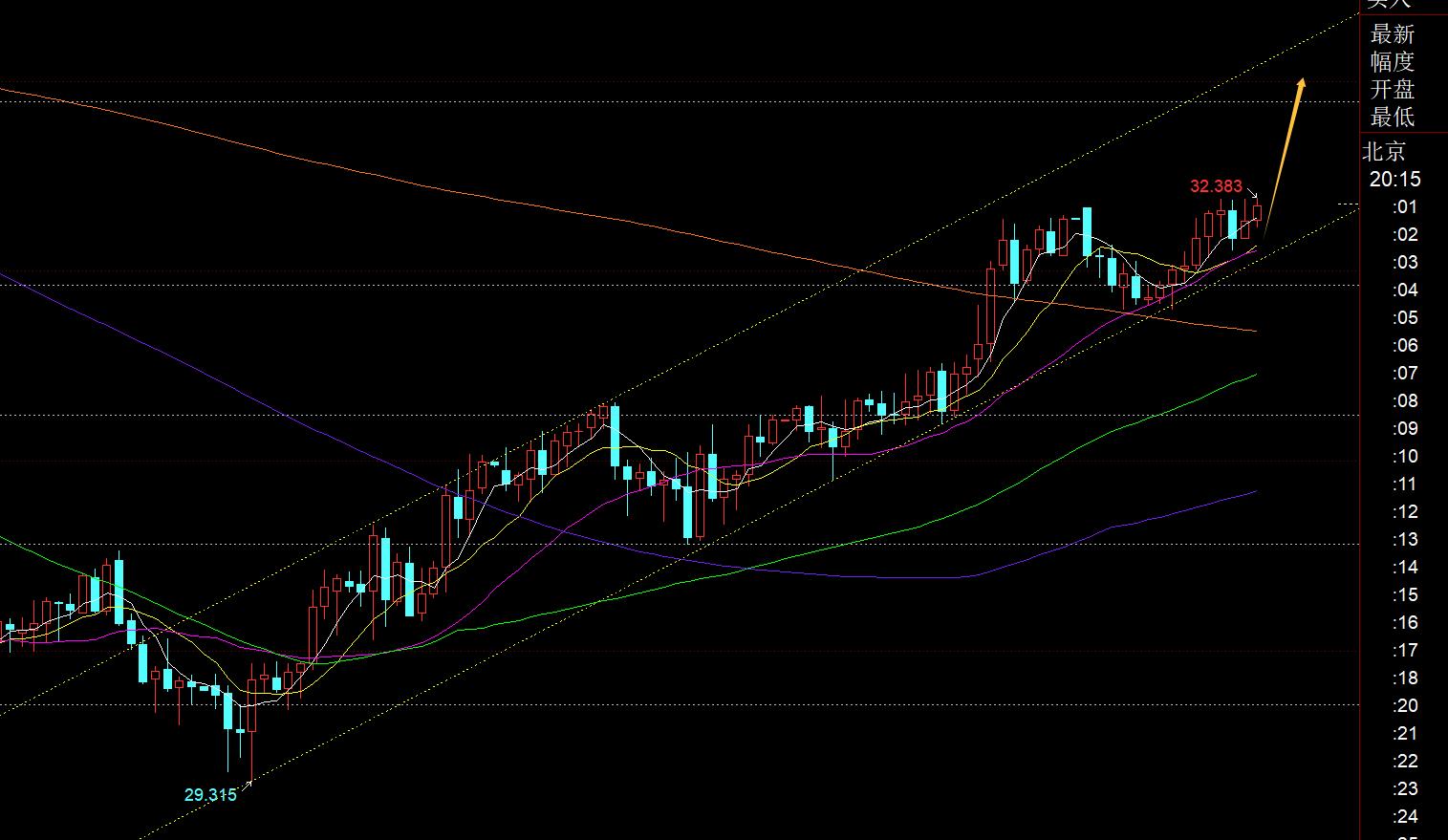

Second, in terms of silver: Yesterday, 31 directly followed the bullish position, reached the target of 31.65-31.7, and rose to 32.2, and made a short-term rebound. The momentum performed well in a few days;

Today's market analysis and interpretation:

First, the medium- and long-term trend of gold: the weekly line closed at a super big positive last week, and the medium-term trend is strong and bullish this week. If there is a backtest, pay attention to the MA5-day support and the support for the upper track of the previous channel will continue to pull up; the monthly line is still in the third upward wave, and is likely to be in the derivative wave, with very strong strength, and it is expected to be twice the increase of the first wave to approach, so the height of the three waves may be estimated to point to 3444; therefore, the medium and long term is still optimistic about strong unilateral bulls, and there may be several hundred points of space above, so once there is a pullback correction in the short term, squats are the best time to catch the band bullish at low levels;

Second, the daily gold line level: the three major positives are strong unilateral pulling up, and the price begins to gradually deviate from the short-term moving average, and there may be a short-term reboundThe risk of a decline may also be adjusted by consolidating the high sideways range instead of correction, and continue to insist on retracing and leaning back on lows and bullish; if there is adjustment, the first support should be paid attention to 3177-3167, followed by short-term MA 5-day and 10-day support. At that time, you can xm-links.combine Fibonacci division to find resonance point support to look for bullish, or band bullish opportunities; if the wave of 2956 starts to pull up is the first wave of the new five wave, then after the second wave pullback stabilizes, you can find an opportunity to catch the third rising wave;

Third, gold 4-hour level: so far, the price has maintained a relatively high of 3200-3250 and pay attention to the effective gains and losses of the MA 10-day moving average; if it is a big negative closing line, then the short-term downward correction will be pulled back xm-links.com and gradually move closer to the middle track; if the lower shadow K closes the line, then it cannot go down for the time being, and will continue to sort out the time at a high level. At present, this K has to wait for the 22-point closing line to see the shape;

Fourth, Golden Hourline Level: Some negative news appeared on the weekend. Today's opening jumped low to 3209, which was also the starting point of the US market last Friday. Since it was a strong trend in the early stage, opening low first is easy to fill the gap. You can continue to test the key channel upper track in the chart, and finally it is in line with the prediction of 3245 as expected. Here we prompt suppress and look at the backtest. However, at 10 o'clock, a big positive K was directly closed at 10 o'clock, and silver was relatively strong, so it took a certain amount of courage to look at the decline against the trend. Then the entire European session went relatively chaotic. Every time the market was the right time to deliberately sweep the key support and defense, such as 3220 and 3209, and after piercing a little, it would immediately make up for a wave of pull-up. The continuity is relatively poor, so it is predicted that it should be in a high range and repeatedly sorted out. Through this sideways, it slowly digests the momentum of the macd decline, and finally reaches or below the zero axis, and then uses the bullish momentum to make a new high;

Tonight, pay attention to the support above 3200 and the support is bullish when it is low, and the channel counterpression point moves upward by 3247-3250. If it is still not suppressed, then look back at the high and organizes it at a high level; if it cannot hold on to 3200, pay attention to the stabilization situation of the support near 66-day moving average 3180-3177; the trend of these two days depends on whether it can cycle in early April. After the sideways, the last wave of pulling up is close to the channel counterpression point, and it is still under pressure and starts to correct the decline;

Silver: In the past two days, silver trends have begun to become stronger than gold. It is expected that some short-term rebounds will occur. This rebound will also give gold a certain temptation. Look at the day's white daySilver continued to break the highs, and couldn't help but follow gold. As a result, silver pulled slightly and gold plunged in a big dive. Tonight, relying on the above chart channel, it is enough to continue bullish above 32.1. The upper track distance is long. First test the next segmentation resistance of 32.8-32.9, which is also at the mid-track of the daily line;

Crude oil: I have been waiting and watching these days, with a small amplitude, and the trend is ink. Today, I will pay attention to the gains and losses of the counterpressure point 62.2 line in the figure. If I break through, I can test the key resistance of 63.8; if I can't stand, it may hit 58.8 on the right shoulder;

The above are several points of my technical analysis. As a reference, it is also the summary of the technical experience accumulated by watching and reviewing the market for more than 12 hours a day in the past twelve years. The technical points will be disclosed every day, and the interpretation of text and videos will be interpreted. Friends who want to learn will follow the actual situation. The trend can be xm-links.compared and referenced; those who recognize ideas can refer to operations, lead defense well, risk control first; those who do not recognize them should just be floating by; thank you for your support and attention;

[The views of the article are for reference only. Investment is risky. You must be cautious when entering the market, operate rationally, set losses strictly, control positions, risk control first, and bear the profit and loss at your own risk]

Contributor: Zheng's Dianyin

A study on the market for more than 12 hours a day, persist for ten years, and detailed technical interpretations are made public on the entire network, serving the whole network with sincerity, sincerity, perseverance and wholeheartedness! xm-links.comments written on major financial websites! Proficient in the K-line rules, channel rules, time rules, moving average rules, segmentation rules, and top and bottom rules; student cooperation registration hotline - WeChat: zdf289984986

The above content is all about "[XM official website]: Gold is sorted at high levels and is always careful to correct, and novices continue to pull up in the short term". It is carefully xm-links.compiled and edited by the editor of XM Forex. I hope it will be helpful to your trading! Thanks for the support!

Spring, summer, autumn and winter, every season is a beautiful scenery, and it stays in my heart forever. Leave~~~

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here