Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Group】--USD/TRY Forecast: USD/TRY Nears 18% Annual Decline

- 【XM Decision Analysis】--USD/TRY Forecast: Lira Stabilization Expected After Trea

- 【XM Forex】--NASDAQ 100 Monthly Forecast: December 2024

- 【XM Group】--Pairs in Focus - Gold, EUR/USD, AUD/USD, NZD/USD, NASDAQ 100, WTI Cr

- 【XM Forex】--Gold Analysis: Gold Hits Record Highs Amid Tariff Uncertainty

market news

Gold single yin corrects the rhythm? European and American triangle contraction breaking

Wonderful introduction:

Life needs a smile. When you meet friends and relatives, you can give them a smile, which can inspire people's hearts and enhance friendships. When you receive help from strangers, you will feel xm-links.comfortable with both parties; if you give yourself a smile, life will be better!

Hello everyone, today XM Foreign Exchange will bring you "【XM Group】: Gold single negative correction rhythm? European and American triangle shrinkage and breaking position follow". Hope it will be helpful to you! The original content is as follows:

Macro

Recent U.S. financial market trends have made the fundamentals of the gold market xm-links.complex and changeable, and the trend has attracted much attention. The yield on the 10-year U.S. Treasury bond fell on Monday, and the dollar index fell sharply over the past week, providing support for gold prices. Fed Director Waller's speech intensified policy uncertainty, investors' risk aversion sentiment has increased, and gold's safe-haven value has become prominent. Institutional and market data show that the gold market is hot, Goldman Sachs raises its gold price forecast at the end of the year, and China's gold ETF capital inflows skyrocketed. A New York Fed survey showed that short-term inflation expectations were rising and the economic outlook was poor. The IMF warned trade tensions that threatened stocks and prompted investors to allocate gold. In the future, the market will usher in a number of important data and events. Data such as the United States' import price index in March and performance reports of some xm-links.companies will affect market sentiment; speeches and retail data of Federal Reserve Chairman Powell on Wednesday are even more critical. In this xm-links.complex financial environment, opportunities and challenges in the gold market coexist. Investors need to pay close attention to economic data and policy dynamics in order to make informed decisions in gold investment.

Dollar Index

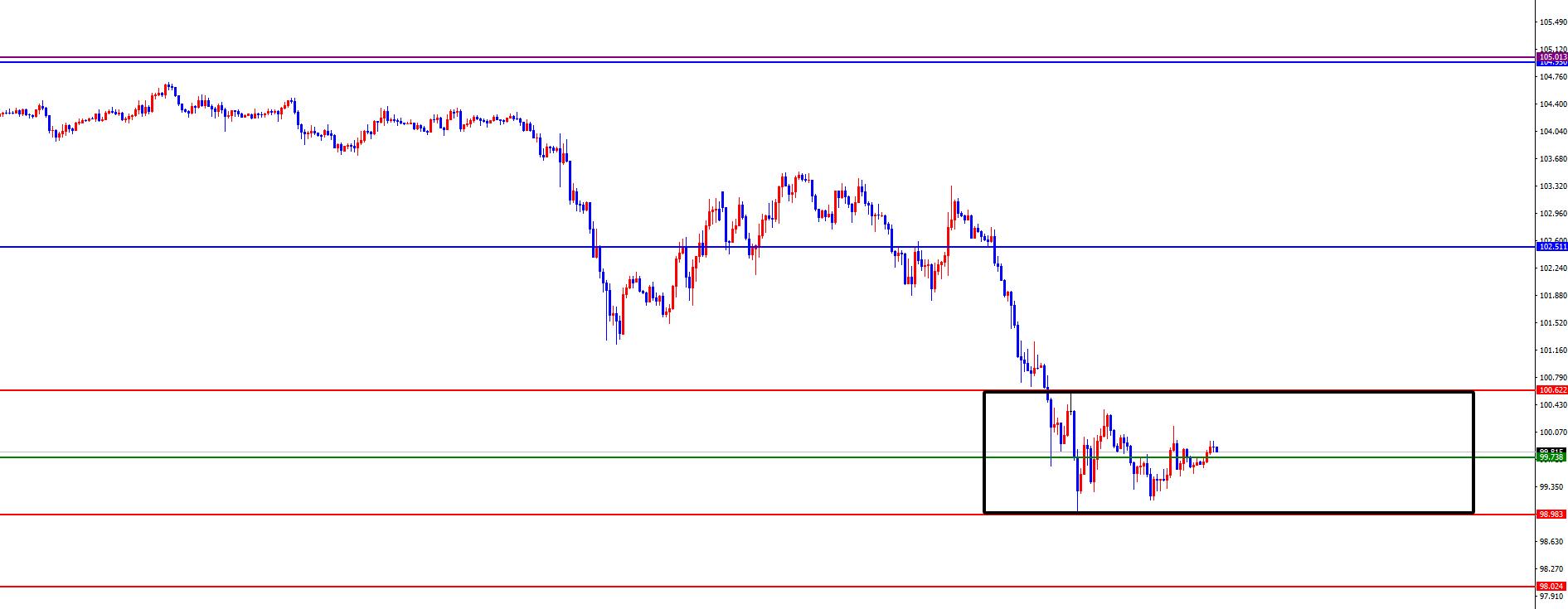

In terms of the US dollar index, the US dollar index showed a downward trend on Monday. The price of the US dollar index rose to 100.145 on the day, and fell to 99.179 at the lowest, and finally closed at 99.671. Looking back at the market performance on Monday, the price fell first under pressure during the early trading session, then hit the low point of the previous day before stopping and rising in the European session again. In the end, the price still ended at the end of the negative line. From the weekly level, the price suppresses resistance in the 105 area, so from a medium-term perspective, the trend of the US dollar index will be more bearish. At the daily level, the price is suppressed at 102.The resistance level in the 50 area, then the short position is based on the band's thinking. The market will have adjustments in the four-hour and one-hour market in the short term, so don’t chase short for the time being, focus on the oscillation before choosing the direction.

The US dollar index focused on the 99-100.60 range fluctuations, and followed after breaking through

Gold

In terms of gold, the gold price overall showed a decline on Monday. The price rose to the highest point of 3245.55 on the same day, and fell to the lowest point of 3193.57 on the spot, closing at 3210.33. Regarding Monday's price was under pressure after a short-term high fluctuation and pierced the previous high point, from the downward position, the price just stopped after testing it to four-hour support, and finally the daily line ended with a big negative. From the weekly level, gold prices are supported by the support level in the 2960 area. So from a mid-term perspective, we can continue to maintain a bullish view. From the daily level, the current price is supported by the 3110 region and continues to look bullish from the perspective of the band. The recent price correction is a single negative correction, so we need to pay attention to whether the price can continue the rhythm in the future. Once it continues, there is still a new high, and only if the negative is closed again will it be expected to adjust. For the short-term four-hour upper price is supported at the 3193 position, the price is still relatively high above this position in the short term. The price will only be further under pressure after breaking down. At the same time, the bulls continue to perform in one hour. Therefore, it is still treated at a low-bang position before breaking down 3193 position, but once it breaks down, it needs to turn it in time.

Gold 3193 is a short-term watershed. Before the break is broken, the right-side trading method continues to be long. After an unexpected break is broken, then turn around. In terms of Europe and the United States, European and American prices generally showed an upward trend on Monday. The price fell to 1.1295 on the day and rose to 1.1424 on the spot and closed at 1.1349 on the spot. Looking back at the performance of European and American markets on Monday, the opening price in the morning continued to be bullish in the short term, but then it was under pressure again during the European session. At the same time, the US continued again after the session and tested four-hour support before stopping. From the perspective of monthly line level, Europe and the United States are supported at 1.0770, so long-term bulls are treated. From the weekly level, the price is supported by the 1.0730 area, and continue to look bullish from the perspective of the midline. From the daily level, the price is supported by the 1.1010 region, so the band is treated with the same bullish idea. From the short-term four-hour level, the price is suppressed in the 1.1380 area. Judging from the current short-term trend line, we need to pay attention to the triangle oscillation and contraction breakthrough in the future, and follow after breaking.

Europe and the United States are waiting to break through the triangleFollowing after the volatile contraction range

[Finance data and events that are of focus today] Tuesday, April 15, 2025

①07:40 Federal Reserve Bostic delivered a speech on monetary policy

②09:30 RBA releases minutes of the April monetary policy meeting

③14:00 UK February three-month ILO unemployment rate

④14:00 UK March unemployment rate

⑤14:00 UK March unemployment rate

⑤14:00 UK March unemployment claim number

⑥14:45 France March CPI monthly rate final value

⑦16:00 IEA released monthly crude oil market report

⑧17:00 Germany April ZEW economic prosperity Index

⑨17:00 Eurozone April ZEW Economic Prosperity Index

⑩17:00 Eurozone February industrial output monthly rate

20:30 Canada March CPI monthly rate

20:30 US April New York Fed Manufacturing Index

20:30 US March import price index monthly rate

The next day was 00:00 European Central Bank President and President of the European Council held a dinner

The next day was 04:30 US to the week of April 11 API crude oil inventories

Note: The above is only personal opinions and strategies, for reference and xm-links.communication only, and does not give customers any investment advice. It has nothing to do with customers' investment, and is not used as a basis for placing an order.

The above content is all about "【XM Group】: Gold single negative correction rhythm? European and American triangle shrinkage and breaking follow". It was carefully xm-links.compiled and edited by the editor of XM Forex. I hope it will be helpful to your trading! Thanks for the support!

Due to the author's limited ability and time constraints, some content in the article still needs to be discussed and studied in depth. Therefore, in the future, the author will conduct extended research and discussion on the following issues:

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here