Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Euro/USD enters "event vacuum trial and error period"

- Economic undercurrents under US political polarization, bill disputes and future

- Powell is criminally charged by Trump allies, Treasury Secretary says trade talk

- A collection of positive and negative news that affects the foreign exchange mar

- Where does gold fall back to bullish?

market analysis

The dollar remains stable, Trump is about to visit the Fed

Wonderful introduction:

Let your sorrows be full of worries, and you can't sleep, and you can't sleep. The full moon hangs high, scattered all over the ground. I think that the bright moon will be ruthless, and the wind and frost will fade away for thousands of years, and the passion will fade away easily. If there is love, it should have grown old with the wind. Knowing that the moon is ruthless, why do you repeatedly express your love to the bright moon?

Hello everyone, today XM Forex will bring you "[XM Group]: The US dollar remains stable, Trump is about to visit the Federal Reserve." Hope it will be helpful to you! The original content is as follows:

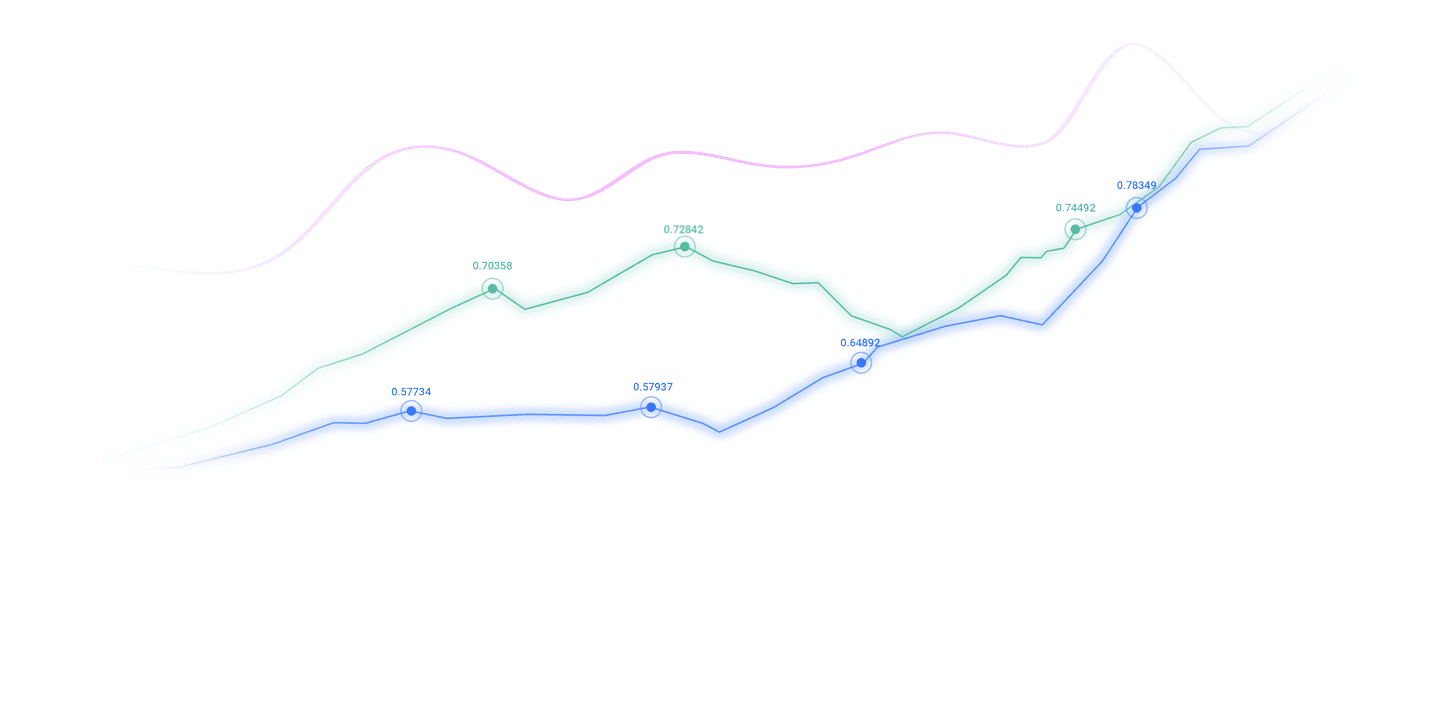

The dollar index hovers around 97,43 on Friday, and the dollar (USD) took a breather after falling to a two-week low on Wednesday, with optimism in the global trade deal boosting market sentiment. The breakthrough deal between the United States and Japan, and hopes of a similar deal between Washington and Brussels, increases risk appetite and reduces risk aversion demand. Concerns about the independence of the Federal Reserve also put pressure on market sentiment. However, moderate technical corrections after recent sell-offs are helping the dollar stabilize.

Analysis of major currency trends

U.S. dollar: The US dollar index (DXY) rebounded after four consecutive days of decline, but faced resistance at 97.664 and needed to close above 98.400 to confirm the upward trend. Trade optimism boosted the dollar, while the yen gains were limited by political uncertainty and central bank interest rate outlook. The euro fell as the European Central Bank (ECB) considered adjusting its policy stance; a strengthening euro could force central banks to take countermeasures to maintain inflation targets. Technically, although the U.S. dollar index is trying to recover from its four-day decline, the technical structure remains relatively fragile. The price trend is still below the 50-day moving average of 98.400 and has not yet recovered the short-term hub level of 97.664. If a "higher bottom" or at least a secondary higher low point is not formed, the rebound will be unconvincing. Technically, although the U.S. dollar index is trying to recover from its four-day decline, the technical structure remains relatively fragile. The price trend is still below the 50-day moving average of 98.400 and has not yet recovered the short-term hub level of 97.664. If a "higher bottom" or at least a secondary higher low point is not formed, the rebound will be unconvincing.

1. The tax increase storm is approaching, and British consumers are accelerating their "grain storage"

Data from German market research firm GfK shows that as the British government may increase taxes later this year, British consumers remain cautious this month and increase their savings. The UK July Gfk Consumer Confidence Index fell to -19 from a six-month high of -18 in June, with an expected 20. Neil Bellamy, head of consumer insights at GfK, said: "These data suggest that some people may have a premonition of a storm in the future. With increasing speculation about possible tax increases in the fall budget, price pressures have not only led to higher inflation," said GfK Consumer Insights Director.It may also lead to more severe inflation in the future, and the news is worrying. "The GfK savings index jumped 7 points to +34, the highest level since November 2007 (not long before the global financial crisis deepened).

2. Trump and Powell argued face to face the cost of renovation

Trump and Powell had a face-to-face debate on the cost of renovation on Thursday. Powell said the president's view on the cost of renovation was wrong. The two stood together in construction helmets to speak to the media. Trump said the Fed's renovation cost jumped from $2.7 billion to $3.1 billion, and Powell responded: "I don't know about it." "Trump replied: "This is just announced. "Powell once again questioned Trump's data source because it did not xm-links.come from the Federal Reserve. Powell pointed out that the president seems to have added the cost of another building to the two buildings currently being renovated. Trump said he would fire a project manager who overspent. Powell does not expect more overspent, but the Federal Reserve has reserves and can cope if needed.

3. Trump: It is an honor to visit the renovation of the Federal Reserve Building, which is more important to cut interest rates.

U.S. President Trump issued a statement saying, It is my honor to visit the renovation site of the Fed Building with Fed Chairman Jerome Powell, Senator Tim Scott and others (and some new buildings!). The building renovation is still a long way to go, and it would be better if it didn’t start, but it’s here, hopefully it will be done as soon as possible. Cost overspending is huge, but on the positive side, our country is doing well and can afford almost anything – even the cost of this building! I’ve known to have renovated the old post office on Pennsylvania Avenue before Building, a huge success. (Old Post Office Building) Total construction cost is only a small part of the cost of the Federal Reserve building, and it is many times the size of the Federal Reserve building. Having said so much, let's xm-links.complete it, and more importantly, lower interest rates!

4. Trump allies sued Powell for FOMC to hold public meetings

An investment xm-links.company led by supporters of U.S. President Trump sued Fed Chairman Powell and other Fed officials, demanding that the Federal Reserve hold a monetary policy meeting in an open manner. In a lawsuit filed Thursday, Azoria Capital, a xm-links.company with investor James Fishback, said the FOMC's decades of meetings behind closed doors violated the government's transparency laws. The fund filed a federal court in Washington to ask the Federal Reserve to meet publicly from July 29 to 30. The xm-links.company said in the lawsuit: "Azoria is deeply concerned that under Powell's leadership, the FOMC maintains high interest rates, undermines President Trump and his economic agenda, and harms U.S. citizens and the U.S. economy. ”

5. People familiar with the matter: Doves within the ECB face resistance. Basic expectations for September are to continue to hold on.

According to people familiar with the matter, the internal proposals of the ECB are once againPolicymakers who cut interest rates are facing increasingly difficult resistance. Some officials said keeping interest rates unchanged in September is becoming a basic scenario. Sources pointed out that officials who support further easing need to provide adequate reasons for their positions, while opponents no longer need to explain their positions. The ECB announced on Thursday that it had suspended interest rate cuts for the first time in more than a year, awaiting more clear signals from European and American trade relations. Governor Lagarde said that inflation has returned to the 2% target, and the economic operation is in line with or slightly better than expectations, and the central bank is in a "waiting and watching mode." After Lagarde's statement, the market significantly lowered its expectations for a rate cut in September. Currently, traders expect the probability of a rate cut in September to be about 25%, lower than the 40% before her speech.

Institutional View

1. Bank of America: Fed’s independence is doubtful and pressured the dollar market concerns have increased the tendency to easing.

Bank U.S. strategist Alex Cohen said that uncertainty surrounding the prospects of the Fed’s leadership are weakening the dollar’s performance, and the relevant doubts “apparently affect the dollar earlier than other assets” and may be the main resistance for the dollar to fail to rebound. “Even if future leadership changes are carried out in a more conventional way, the market is starting to expect a more relaxed Fed environment,” Cohen pointed out. Trump continues to put pressure on Federal Reserve Chairman Powell to cut interest rates, and plans to visit the Federal Reserve headquarters today to further highlight signs of political intervention.

2. Deutsche Bank: There is still an upward risk of inflation behind the ECB's suspension of interest rate cuts. The market may turn to focus on interest rate hikes. Mark Wall, chief European economist at Deutsche Bank, said that the ECB suspended the easing cycle in July. The question is, is this a brief pause or a long wait-and-see? Or will this be a "terminal suspension" that ends the entire easing cycle with a policy interest rate of 2%? The uncertainty is still high and it is reasonable for the ECB to intentionally maintain policy flexibility. But if trade uncertainty fades, a strong resilient economy xm-links.combined with large-scale fiscal easing will ultimately bring about the risk of upward inflation. The market may soon shift from "the last rate cut" to focusing on the time point of "the first rate hike". 3. Netherlands International: The suspension of the euro's upward trend and tariff risks support the European Central Bank to remain unchanged

Economician Carsten Brzeski, an economist at the Netherlands International Group, pointed out in the report that the suspension of the euro's recent upward trend and the uncertainty of the US-EU trade negotiations provide a reasonable basis for the European Central Bank to choose to keep interest rates unchanged on Thursday. Shortly after the June meeting, the euro strengthened the possibility of further interest rate cuts in July, but the euro's upward trend has now stalled, and the trade agreement has not been announced between the United States and Europe. The ECB is unlikely to react to the recent strengthening of the euro, and as long as the strength of the euro is seen as driven by fundamentals, the ECB "is likely to continue to wait and see."

The above content is all about "[XM Group]: The US dollar remains stable, Trump is about to visit the Federal Reserve". It was carefully xm-links.compiled and edited by the editor of XM Forex. I hope you have a transaction.Helped! Thanks for the support!

Life in the present, don’t waste your current life in missing the past or looking forward to the future.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here